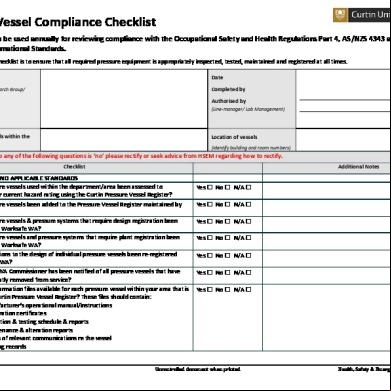

Statutory Compliance Checklist. 6lg6o

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 445h4w

Overview 1s532p

& View Statutory Compliance Checklist. as PDF for free.

More details 6h715l

- Words: 660

- Pages: 3

HR Check List for Statutory Records & Returns 1. The Factories Act, 1948

* of Compensatory Holidays Form -8 * of Adult Workers Form-11 * of Leave with Wage Form-14 * Muster Roll Form-22 * of Accident & Dangerous Occurrences Form-23 * Inspection Book * Half yearly Returns - Form - 21 (Before 15th of July & January of every year in duplicate) * Accident & Dangerous Occurrences - Form - 23 (Every Month) * Combined Annual Returns - Form - 20, (Before January every year) * Notice of Adult workers - Form – 10 * Abstract of Factories Act, 1948 2. Payment of Wages Act, 1936

* of Fines * of Advance * of Deductions * of Wages * Annual Return * Payment of Wages Abstract * Notice of rates of wages * Notice of Date of Payment

-

Form – IV (in duplicate, before Feb, 15 of every year to inspector of factories, cc: Labour Insp.) - Form - V - Form - VI

3. Minimum Wages Act, 1936 * Wage * Over Time * Annual Return * Abstract of Minimum Wages * Minimum rate of Wages fixed Form-XI, XII & XIII * Name, Address of Inspector

-

Form-III (Feb. 1) Form-V

4. Payment of Gratuity Act * Notice of opening * Declaration * Payment of Gratuity Act, Abstract

-

Form – A ( To: Labour Department) Form – F

5. Payment of Bonus Act, 1965 * of Bonus * Annual Returns * Payment of Bonus Abstract

Form - C Form-D (Before December every year)

6. Equal Remuneration Act, 1976 * Equal Remuneration

-

Form – D

7. Industrial Employment (Standing Order), 1946. Standing Order to be displayed on Notice Board 8. Kerala Shops & Commercial Establishment Act 1960 * Consolidated containing 8 Forms * Inspection Book * Quarterly Return * Annual Return -

Form H (10th April, July, Oct & Jan) Form – B1 (Before 30th of November)

9. National & Festival Holidays Act * Form – V (Annual Return, Before 31st January) 10. Kerala state Labour Welfare Fund * Half Yearly Contribution (both employee & employer, Rs. 4/- & Rs. 8/- respectively) on every Jan & July (To be deducted from December and June salary) 11. The Contract Labour (Regulation & Abolition) Act, 1970 * Registration Certificate (Before appointing contractor) Form-1 * of Contractors Form-XII * of Employees employed by Contractor Form-XIII * Muster Roll, Wage , Over Time * Fine , Deduction , Advance (contractor) * Notice regarding rates of wages * Display of the Act & Rules both in English & Malayalam * Half yearly return by contractor - Form – XXIV (January & July) * Annual Return by Principle Employer - Form – XXV (before 15th Feb)

12. Kerala Municipalities Act 1994 Contribution of PT to local bodies (Before 31st March and 30th September) (To be deducted from February and August salary) 13. Employee State Insurance Corporation Act, 1948 * Muster Roll * Wage * Inspection Book * Accident * Cash Books, Vouchers & Ledgers * Paid Challans * of Employees * Half Yearly Return

-

Form -- 7 Form – 6 (Apr - Sep & Oct – Mar) 42 days after closing Contribution Period

14. Employees Provident Fund Act, 1952. * Muster Roll * Wage * Form - 3A, 5, 10 & 12A * Inspection Book * Cash Book, Voucher & Ledger * PF work sheet * Monthly return - Form – 5, 10, 12A along with paid challans (before 25th of every month) * Annual Return - Form – 3A & 6A (before 30th April every year) 15. Maternity Benefit Act, 1961 * Abstract

-

Form – G

16. Employment Exchange (CNV) Act. * Notification of Vacancies * Quarterly Return * Bi- Annual Return

-

Form – 6 Form: ER-I (Mar, June, Sep, Dec) Form: ER-II (Once in 2 years)

* of Compensatory Holidays Form -8 * of Adult Workers Form-11 * of Leave with Wage Form-14 * Muster Roll Form-22 * of Accident & Dangerous Occurrences Form-23 * Inspection Book * Half yearly Returns - Form - 21 (Before 15th of July & January of every year in duplicate) * Accident & Dangerous Occurrences - Form - 23 (Every Month) * Combined Annual Returns - Form - 20, (Before January every year) * Notice of Adult workers - Form – 10 * Abstract of Factories Act, 1948 2. Payment of Wages Act, 1936

* of Fines * of Advance * of Deductions * of Wages * Annual Return * Payment of Wages Abstract * Notice of rates of wages * Notice of Date of Payment

-

Form – IV (in duplicate, before Feb, 15 of every year to inspector of factories, cc: Labour Insp.) - Form - V - Form - VI

3. Minimum Wages Act, 1936 * Wage * Over Time * Annual Return * Abstract of Minimum Wages * Minimum rate of Wages fixed Form-XI, XII & XIII * Name, Address of Inspector

-

Form-III (Feb. 1) Form-V

4. Payment of Gratuity Act * Notice of opening * Declaration * Payment of Gratuity Act, Abstract

-

Form – A ( To: Labour Department) Form – F

5. Payment of Bonus Act, 1965 * of Bonus * Annual Returns * Payment of Bonus Abstract

Form - C Form-D (Before December every year)

6. Equal Remuneration Act, 1976 * Equal Remuneration

-

Form – D

7. Industrial Employment (Standing Order), 1946. Standing Order to be displayed on Notice Board 8. Kerala Shops & Commercial Establishment Act 1960 * Consolidated containing 8 Forms * Inspection Book * Quarterly Return * Annual Return -

Form H (10th April, July, Oct & Jan) Form – B1 (Before 30th of November)

9. National & Festival Holidays Act * Form – V (Annual Return, Before 31st January) 10. Kerala state Labour Welfare Fund * Half Yearly Contribution (both employee & employer, Rs. 4/- & Rs. 8/- respectively) on every Jan & July (To be deducted from December and June salary) 11. The Contract Labour (Regulation & Abolition) Act, 1970 * Registration Certificate (Before appointing contractor) Form-1 * of Contractors Form-XII * of Employees employed by Contractor Form-XIII * Muster Roll, Wage , Over Time * Fine , Deduction , Advance (contractor) * Notice regarding rates of wages * Display of the Act & Rules both in English & Malayalam * Half yearly return by contractor - Form – XXIV (January & July) * Annual Return by Principle Employer - Form – XXV (before 15th Feb)

12. Kerala Municipalities Act 1994 Contribution of PT to local bodies (Before 31st March and 30th September) (To be deducted from February and August salary) 13. Employee State Insurance Corporation Act, 1948 * Muster Roll * Wage * Inspection Book * Accident * Cash Books, Vouchers & Ledgers * Paid Challans * of Employees * Half Yearly Return

-

Form -- 7 Form – 6 (Apr - Sep & Oct – Mar) 42 days after closing Contribution Period

14. Employees Provident Fund Act, 1952. * Muster Roll * Wage * Form - 3A, 5, 10 & 12A * Inspection Book * Cash Book, Voucher & Ledger * PF work sheet * Monthly return - Form – 5, 10, 12A along with paid challans (before 25th of every month) * Annual Return - Form – 3A & 6A (before 30th April every year) 15. Maternity Benefit Act, 1961 * Abstract

-

Form – G

16. Employment Exchange (CNV) Act. * Notification of Vacancies * Quarterly Return * Bi- Annual Return

-

Form – 6 Form: ER-I (Mar, June, Sep, Dec) Form: ER-II (Once in 2 years)