Individual Taxation Chapters 1-5 6z2c2d

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 445h4w

Overview 1s532p

& View Individual Taxation Chapters 1-5 as PDF for free.

More details 6h715l

- Words: 10,878

- Pages: 28

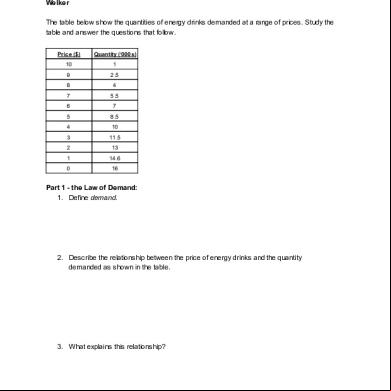

Name: ________________________ Class: ___________________ Date: __________

ID: A

BUSA307 - Federal Taxation, Sample Exam 1 Chapters 1-5 True/False Indicate whether the statement is true or false. ____

1. Julie inherits her mother’s personal residence, which she converts to a furnished rent house. This change should affect the amount of ad valorem property taxes levied on the properties.

____

2. Julius, a married taxpayer, makes gifts to each of his six children. Only six per donee annual exclusions will be allowed as to these gifts.

____

3. The due dates for filing state income tax returns most often are the same as the due date of the Federal income tax return.

____

4. The IRS is required to redetermine the interest rate on underpayments and overpayments once a year.

____

5. During any month in which both the failure to file penalty and the failure to pay penalty apply, the failure to file penalty is reduced by the amount of the failure to pay penalty.

____

6. The tax law provides various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education. These provisions can be justified on both economic and equity grounds.

____

7. As it is consistent with the wherewithal to pay concept, the tax law permits a seller to recognize gain in the year the installment sale took place.

____

8. The 1954 Code codification substantially changed the tax law existing on the date of its enactment.

____

9. Regular decisions of the Tax Court generally involve novel issues previously resolved by the U.S. Tax Court.

____ 10. The following citation cannot be correct: Jack D. Carr, T.C. Memo. 1985-19. ____ 11. Online research systems are generally less costly than CD-ROM services. ____ 12. Kim, a citizen of Korea, is a resident of the U.S. Any income Kim receives from land he owns in Korea is not subject to the U.S. income tax. ____ 13. An increase in the amount of a taxpayer’s AGI can reduce the amount of medical expenses allowed as a deduction. ____ 14. Darren, age 20 and not disabled, earns $4,500 during 2006. Darren’s parents cannot claim him as a dependent unless he is a full-time student. ____ 15. Stealth taxes are directed at higher income taxpayers. ____ 16. When the kiddie tax applies, the child need not file an income tax return as the child’s income will be reported on the parents’ return. ____ 17. Regardless of the standard deduction and exemption amounts, a self-employed individual with net earnings of $400 or more from a business or profession must file a Federal income tax return. ____ 18. In 2006, Tony is a widower and maintains a household in which he and his unmarried daughter, Marie, live. If Marie is not Tony’s dependent, he cannot claim head of household filing status. ____ 19. On June 30, 2006, an accrual basis taxpayer sold a contract to provide the same service each month for 36 months, July 2006 through June 2009. The contract price received was $3,600. The taxpayer may recognize $600 gross income in 2006 and $3,000 in 2007. 1

Name: ________________________

ID: A

____ 20. George and Erin are divorced, and George is required to pay Erin $20,000 of alimony each year. George earns $75,000 a year. Erin is not required to include the alimony payments in gross income because George earned the income and therefore he should pay the tax on the income. ____ 21. In the case of a below-market gift loan for which there is no exception to the imputed interest rules, the lender must recognize imputed interest income. ____ 22. Susan purchased an annuity for $120,000. She is to receive $15,000 each year and her life expectancy is 12 years. If Susan collects under the annuity for 13 years, the entire $15,000 received in the 13th year must be included in her gross income. ____ 23. If a Nobel peace prize winner transfers the prize to a qualified government unit or nonprofit organization, then the prize is excluded from the winner’s gross income if the amount of the prize does not exceed 50% of the winner’s AGI. ____ 24. Norma’s income for 2006 is $27,000 from part-time work and $9,000 of Social Security benefits. Norma is not married. A portion of her Social Security benefits must be included in her gross income. ____ 25. Sam received $25,000 of salary, interest, and dividends in 2006. He also received $10,000 as worker’s compensation benefits. Sam must include either 50% or 85% of the worker’s compensation benefits in gross income for 2006. Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 26. Which, if any, of the following statements best describes the history of the Federal income tax? a. It existed during the Civil War. b. The Federal income tax on corporations was held by the U.S. Supreme Court to be contrary to the U.S. Constitution. c. The Federal income tax on individuals was held by the U.S. Supreme Court to be allowable under the U.S. Constitution. d. Both the Federal income tax on individuals and on corporations was held by the U.S. Supreme Court to be contrary to the U.S. Constitution. e. None of the above. ____ 27. Which, if any, of the following taxes is progressive (rather than proportional)? a. A city’s excise tax on hotel occupancy. b. Medicare component of FICA and FUTA. c. Federal gas guzzler tax. d. Value added taxes. e. None of the above. ____ 28. Which, if any, of the following occurrences will increase a taxing jurisdiction’s revenue from ad valorem taxes imposed on real estate? a. A tax holiday expires. b. The state condemns farmland for a prison facility. c. A church builds a school on vacant land it already owns. d. An apartment building is acquired by a university for use as a dormitory.. e. None of the above.

2

Name: ________________________

ID: A

____ 29. A use tax is imposed by: a. The Federal government and all states. b. The Federal government and a majority of the states. c. A minority of the states and not the Federal government. d. All states and not the Federal government. e. None of the above. ____ 30. Property can be transferred within the family group by gift or at death. One motivation for preferring the gift approach is: a. To take advantage of the per donee annual exclusion. b. To avoid a future decline in value of the property transferred. c. To take advantage of the higher unified transfer tax credit available under the gift tax. d. To shift income to higher bracket donees. e. None of the above. ____ 31. State income taxes can: a. Piggyback to the Federal version. b. Decouple from the Federal version. c. Apply to visiting nonresidents. d. Provide occasional amnesty programs. e. All of the above. ____ 32. A characteristic of FICA is that: a. It is imposed only on the employer. b. It applies when a 19-year-old son works for his parents. c. It provides a modest source of income in the event of loss of employment. d. It is istered by both state and Federal governments. e. None of the above. ____ 33. The proposed flat tax: a. Would simplify the income tax. b. Would eliminate the income tax. c. Would tax the increment in value as goods move through the production and manufacturing stages to the marketplace. d. Is a tax on consumption. e. None of the above. ____ 34. Which of the following is characteristic of the IRS audit procedure? a. The percentage of individual income tax returns that the IRS audits has significantly increased over the years. b. An office audit takes place at the office of the taxpayer. c. One of the factors that leads to an audit is the information provided by informants. d. Only IRS special agents can conduct field audits. e. None of the above. ____ 35. Aidan files his tax return 65 days after the due date. Along with the return, Aidan remits a check for $6,000 which is the balance of the tax owed. Disregarding the interest element, Aidan’s total failure to file and to pay penalties are: a. $90. b. $810. c. $900. d. $990. e. None of the above.

3

Name: ________________________

ID: A

____ 36. The Internal Revenue Code was codified for the first time in what year? a. 1913. b. 1923. c. 1939. d. 1954. e. 1986. ____ 37. Which of the following types of Regulations has the highest tax validity? a. Temporary. b. Legislative. c. Interpretative. d. Procedural. e. None of the above. ____ 38. In assessing the importance of a regulation, an IRS agent must: a. Give equal weight to the Code and regulations. b. Give more weight to the Code rather than to a regulation. c. Give more weight to the regulation rather than to the Code. d. Give less weight to the Code rather than to a regulation. e. None of the above. ____ 39. If a taxpayer decides not to pay a tax deficiency, he or she must go to which court? a. Appropriate U.S. Circuit Court of Appeals. b. U.S. District Court. c. U.S. Tax Court. d. U.S. Court of Federal Claims. e. None of the above is available. ____ 40. Interpret the following citation: 64-1 USTC ¶9618, aff’d in 344 F. 2d 966. a. A U.S. Tax Court Small Cases Division decision that was affirmed on appeal. b. A U.S. Tax Court decision that was affirmed on appeal. c. A U.S. District Court decision that was affirmed on appeal. d. A U.S. Circuit Court of Appeals decision that was affirmed on appeal. e. None of the above. ____ 41. Court(s) with more than one judge include: a. U.S. Court of Federal Claims. b. U.S. Tax Court. c. U.S. Supreme Court. d. Only b. and c. e. a., b., and c. ____ 42. A Memorandum decision of the U.S. Tax Court could be cited as: a. T.C.Memo. 1990-650. b. 68-1 USTC ¶9200. c. 37 AFTR2d 456. d. All of the above. e. None of the above.

4

Name: ________________________

ID: A

____ 43. A taxpayer who loses in the U.S. Court of Federal Claims may appeal directly to which court? a. Supreme Court. b. Federal Circuit Court of Appeals. c. U.S. Court of Appeals for the District of Columbia. d. U.S. Tax Court. e. None of the above. ____ 44. Which, if any, of the following items is a deduction for AGI? a. Moving expenses. b. Union dues. c. Child payments. d. Tax return preparation fee. e. None of the above. ____ 45. During 2006, Margaret had the following transactions: Salary Interest income on City of Albuquerque bonds Damages for personal injury (car accident) Punitive damages (same car accident) Cash dividends from General Electric stock

$60,000 1,000 30,000 50,000 2,000

Margaret’s AGI is: a. $60,000. b. $62,000. c. $92,000. d. $112,000. e. $142,000. ____ 46. Toby, age 15, is claimed as a dependent by his grandmother. During 2006, Toby had interest income from City of Omaha bonds of $1,000 and earnings from a part-time job of $700. Toby’s taxable income is: a. $0. b. $1,700 – $700 – $850 = $150. c. $1,700 – $1,000 = $700. d. $1,700 – $850 = $850. e. None of the above. ____ 47. A qualifying child cannot include: a. A nonresident alien. b. A married son who files a t return. c. A cousin. d. A daughter who is away at college. e. A grandson who is 28 years of age and disabled. ____ 48. Kyle, whose wife died in December 2003, filed a t tax return for 2003. He did not remarry, but has continued to maintain his home in which his two dependent children live. What is Kyle’s filing status as to 2006? a. Head of household. b. Surviving spouse. c. Single. d. Married filing separately. e. None of the above.

5

Name: ________________________

ID: A

____ 49. Emily, whose husband died in December 2006, maintains a household in which her dependent daughter lives. Which (if any) of the following is her filing status for the tax year 2006? (Note: Emily is the executor of her husband’s estate.) a. Single. b. Married, filing separately. c. Surviving spouse. d. Head of household. e. Married, filing tly. ____ 50. Wilma is married to Herb, who abandoned her in 2004. She has not seen or communicated with him since June of that year. She maintains a household in which she and her two dependent children live. Which of the following statements about Wilma’s filing status in 2006 is correct? a. Wilma can use the rates for single taxpayers. b. Wilma can file a t return with Herb. c. Wilma can file as a surviving spouse. d. Wilma can file as a head of household. e. None of the above statements is true. ____ 51. During the year, Kim sold the following assets: business auto for a $1,000 loss, stock investment for a $1,000 loss, and pleasure yacht for a $1,000 loss. Presuming adequate income, how much of these losses may Kim claim? a. $0. b. $1,000. c. $2,000. d. $3,000. e. None of the above. ____ 52. Perry is in the 33% tax bracket. During 2006, he had the following capital asset transactions: Gain from the sale of a stamp collection (held for 10 years) Gain from the sale of an investment in land (held for 4 years) Gain from the sale of stock investment (held for 8 months)

$30,000 10,000 4,000

Perry’s tax consequences from these gains are as follows: a. (15% $10,000) + (28% $30,000) + (33% $4,000). b. (15% $30,000) + (33% $4,000). c. (5% $10,000) + (28% $30,000) + (33% $4,000). d. (15% $40,000) + (33% $4,000). e. None of the above. ____ 53. Joan is in the 15% tax bracket and had the following capital asset transactions during 2006: Long-term gain from the sale of a coin collection Long-term gain from the sale of a land investment Short-term gain from the sale of a stock investment Joan’s tax consequences from these gains are as follows: a. (5% $10,000) + (15% $13,000). b. (5% $10,000) + (28% $11,000) + (15% $2,000). c. (15% $13,000) + (28% $11,000). d. (15% $23,000). e. None of the above. 6

$11,000 10,000 2,000

Name: ________________________

ID: A

____ 54. During 2006, Gerald has the following capital transactions: LTCG Long-term collectible gain STCG STCL

$3,000 1,000 2,000 5,000

After the netting process, the following results: a. Long-term collectible gain of $1,000. b. LTCG of $3,000, Long-term collectible gain of $1,000, and a STCL of $3,000. c. LTCG of $3,000, Long-term collectible gain of $1,000, and a STCL carryover to 2007 of $3,000. d. LTCG of $1,000. e. None of the above. ____ 55. Able Corporation sued Baker Corporation for intentional damage to Able’s goodwill. Able had created its goodwill through providing high-quality services to its customers. Thus, no basis for the goodwill appeared on Able’s balance sheet. The suit was settled and Able received $2,000,000, the estimated profits lost because of Baker’s damage infliction. a. The $2,000,000 is not taxable because it replaces the goodwill destroyed. b. The $2,000,000 is not taxable because Able did nothing to earn the money. c. The $2,000,000 is not taxable because it represents a recovery of capital. d. The $2,000,000 is not taxable because Able settled the case. e. None of the above. ____ 56. Turner, a successful executive, is negotiating a compensation plan with his potential employer. The employer has offered to pay Turner a $720,000 annual salary, payable at the rate of $60,000 per month. Turner counteroffers to receive a monthly salary of $50,000 ($600,000 annually) and a $180,000 bonus in 5 years when Turner will be age 65. a. If the employer accepts Turner’s counteroffer, Turner will recognize $65,000 ($780,000 ÷ 12) each month. b. If the employer accepts Turner’s counteroffer, Turner will be in constructive receipt of $60,000 per month. c. If the employer accepts Turner’s counteroffer, Turner will be in constructive receipt of $60,000 per month and the $180,000 bonus. d. If the employer accepts Turner’s counteroffer, Turner will recognize as gross income $50,000 per month and $180,000 in year 5. e. None of the above. ____ 57. The annual increase in the cash surrender value of a life insurance policy is not recognized as income each year because: a. Life insurance is never taxable. b. The amount of the increase is difficult to determine. c. The policyholder must cancel the policy to receive the increase. d. The amount is included in the gross income of the beneficiary when the life insurance proceeds are received upon the death of the insured. e. None of the above.

7

Name: ________________________

ID: A

____ 58. Home Office, Inc., an accrual basis taxpayer, leased a copying machine to a new customer on December 27, 2006. The machine was to rent for $500 per month for a period of 36 months beginning January 1, 2007. The customer was required to pay the first and last month’s rent at the time the lease was signed. The customer also was required to pay an $800 damage deposit. Home Office must recognize as income from the lease in 2006: a. $0. b. $500. c. $1,000. d. $1,800. e. None of the above. ____ 59. Orange Cable TV Company, an accrual basis taxpayer, allows its customers to pay by the year in advance ($350 per year), or two years in advance ($680). In September 2006, the company collected the following amounts applicable to future services: October 2006-September 2008 services (two-year contracts) October 2006-September 2007 services (one-year contracts) Total

$ 72,000 64,000 $136,000

As a result of the above, Orange Cable should report as gross income: a. $136,000 in 2006. b. $64,000 in 2006. c. $84,000 in 2007. d. $111,000 in 2007. e. None of the above. ____ 60. Theresa, a cash basis taxpayer, sold a bond in 2006 for $2,800, which included $400 of accrued interest. In 2003, she had paid $3,200 for the bond including $450 of accrued interest. As a result of the above: I. II. III. IV.

Theresa has a $350 loss on the sale of the bond. Theresa has $400 of interest income. Theresa has a $600 loss on the sale of the bond. None of the above.

a. I and II are correct, but not III or IV. b. II and III are correct, but not I or IV. c. Only II is correct. d. Only IV is correct. ____ 61. Jim and Nora, residents of a community property state, were married in 2004. Late in 2004 they separated, and in 2006 they were divorced. Each earned a salary, and they received income from community owned investments in all relevant years. They filed separate returns in 2005 and 2006. a. In 2005 and 2006, Nora must report only her salary and one-half of the income from community property on her separate return. b. In 2005, Nora must report on her separate return one-half of the Jim and Nora salary and one-half of the community property income. c. In 2006, Nora must report on her separate return one-half of the Jim and Nora salary for the period they were married as well as one-half of the community property income and her income earned after the divorce. d. In 2006, Nora must report only her salary on her separate return. e. None of the above. 8

Name: ________________________

ID: A

____ 62. The alimony recapture rules are intended to: a. Assist former spouses in collecting alimony when the other spouse moves to another state. b. Prevent tax deductions for property divisions. c. Protect former spouses from having a large tax liability after the payments have already been spent. d. Distinguish child payments from alimony. e. None of the above. ____ 63. Under the of a divorce agreement, Kim was to pay her husband Tom $4,000 per month in alimony and $1,500 per month in child . For a twelve-month period, Kim can deduct from gross income (and Tom must include in gross income): a. $0. b. $18,000. c. $48,000. d. $66,000. e. None of the above. ____ 64. Under the of a divorce agreement, Jack is to pay his wife Jenny $5,000 per month. The payments are to be reduced to $3,000 per month when their 15 year-old child reaches age 18. During the current year, Jack paid $60,000 under the agreement. Assuming all of the other conditions for alimony are satisfied, Jack can deduct from gross income (and Jenny must include in gross income) as alimony: a. $36,000. b. $24,000. c. $12,000. d. $0. e. None of the above. ____ 65. The effects of a below-market loan for $450,000 made by a corporation to its chief executive officer as an enticement to get him to remain with the company are: a. The corporation has imputed interest income and compensation expense. b. The employee has imputed interest income and interest expense. c. The employee has no income unless the funds are invested and produce investment income for the year. d. The corporation has imputed interest expense. e. None of the above. ____ 66. Jay, a single taxpayer, retired from his job as a public school teacher in 2006. He is to receive a retirement annuity of $1,000 each month and his life expectancy is 150 months. He contributed $30,000 to the pension plan during his 35-year career; so his adjusted basis is $30,000. What is the correct method for reporting the pension income? a. Since Jay is no longer working, none of the pension must be included in his gross income. b. The first $30,000 received is a nontaxable recovery of capital, and all subsequent annuity payments are taxable. c. The first $120,000 he receives is taxable and the last $30,000 is a nontaxable recovery of capital. d. For the first 150 months, 20% ($30,000/$150,000) of the amount received is a nontaxable recovery of capital and the balance is included in gross income. e. None of the above.

9

Name: ________________________

ID: A

____ 67. Red, Inc. provides group term life insurance to the officers of the corporation only. Susan, a vice-president, received $200,000 of coverage for the year at a cost to Red, Inc. of $2,800. The Uniform s (based on Susan’s age) are $8 a year for $1,000 protection. How much of this must Susan include in gross income this year? a. $0. b. $1,200. c. $1,600. d. $2,800. e. None of the above. ____ 68. Tom, who is unmarried, receives Social Security benefits of $15,000 a year and has $30,000 interest and dividend income. Tom’s marginal tax rate is 15%. If Tom undertakes a consulting job that pays him $1,000, the marginal tax on the income is: a. $150. b. More than $150, but less than $300. c. Less than $150. d. $300. e. None of the above. ____ 69. Our tax laws encourage taxpayers to ____ assets that have declined in value and ____ assets that have appreciated in value. a. sell, sell b. sell, keep c. keep, sell d. keep, keep e. None of the above. ____ 70. Cash received by an individual: a. May be included in gross income although the payor is not legally obligated to make the payment. b. Is not taxable unless the payor is legally obligated to make the payment. c. Must always be included in gross income. d. Is not included in gross income if it was not earned. e. None of the above. ____ 71. Carin, a widow, elected to receive the proceeds of a $100,000 life insurance policy on the life of her deceased husband in 10 installments of $15,000 each. Her husband had paid s of $75,000 on the policy. Over the life of the installment contract, Carin must include in gross income: a. $0. b. $50,000. c. $75,000. d. $100,000. e. None of the above.

10

Name: ________________________

ID: A

____ 72. Swan Finance Company, an accrual method taxpayer, requires all of its customers to carry credit life insurance. If a customer dies, the company receives from the insurance company the balance due on the customer’s loan. Ali, a customer, died owing the company $1,000. The balance due included $100 accrued interest that Swan had included in income. When Swan collects $1,000 from the insurance company, Swan: a. Does not recognize income because life insurance proceeds are tax-exempt. b. Must recognize $900 income from the life insurance proceeds. c. Must recognize $1,000 income from the life insurance proceeds. d. Does not recognize income from the life insurance because the entire amount is a recovery of capital. e. None of the above. ____ 73. In 2006, Ted was diagnosed with a terminal illness. His physician estimated that Ted would live no more than 18 months. Ted cashed in his life insurance policy to pay some medical bills, after he received the doctor’s diagnosis. Ted has paid $12,000 in s and he collected $25,000, the cash surrender value of the policy. George enjoys excellent health, but he cashed in his life insurance policy to purchase a new home. He had paid s of $12,000 and collected $25,000 from the insurance company. a. Neither Ted nor George is required to recognize gross income. b. Both Ted and George must recognize $13,000 ($25,000 – $12,000) gross income. c. Ted must recognize $13,000 ($25,000 – $12,000) of gross income, but George does not recognize any gross income. d. George must recognize $13,000 ($25,000 – $12,000) of gross income, but Ted does not recognize any gross income. e. None of the above. ____ 74. Roger, age 19, is a full-time student at State College and a candidate for a bachelor’s degree. During 2006, he received the following payments: State scholarship for ten months (tuition and books) Loan from college financial aid office Cash from parents Interest on CDs Cash prize awarded in contest

$ 3,600 1,500 3,000 1,700 500 $10,300

What is Roger’s adjusted gross income for 2006? a. $1,700. b. $2,200. c. $5,800. d. $10,300. e. None of the above. ____ 75. Barney, a full-time graduate student, receives a full tuition waiver ($5,500 during the year) and a monthly stipend for 9 months of $500 from State University for performing research for the university as a graduate assistant ($4,500 during the year). In addition, he receives a $2,000 research grant to pursue his own research and studies. Barney’s gross income from the above is: a. $0. b. $4,500. c. $10,000. d. $12,000. e. None of the above.

11

Name: ________________________

ID: A

____ 76. Sally sued her former employer for a back injury she suffered on the job in 2005. As a result of the injury, she was partially disabled. In 2006, she received $250,000 for her loss of future income, $150,000 in punitive damages because of the employer’s flagrant disregard for the employee’s safety, and $10,000 for medical expenses. Sally had deducted $6,000 (the amount in excess of 7.5% of adjusted gross income) in medical expenses in 2005. Sally’s 2006 gross income from the above is: a. $410,000. b. $404,000. c. $160,000. d. $150,000. e. None of the above. ____ 77. Early in the year, Mike was in an automobile accident during the course of his employment. As a result of the injuries he sustained, he received the following payments during the year: Worker’s compensation benefit Reimbursement of medical expenses from the company’s group medical insurance plan Regular salary under the company’s sick pay plan

$4,000 6,000 5,000

What is the amount that Mike must include in gross income for the current year? a. $15,000. b. $11,000. c. $9,000. d. $5,000. e. None of the above. ____ 78. Jack received a court award for $100,000 for damages to his personal reputation by the National Gossip. He also received $50,000 in punitive damages. Jack must include in his gross income as a damage award: a. $0. b. $50,000. c. $100,000. d. $150,000. e. None of the above. ____ 79. Olaf was injured in an automobile accident and received $25,000 for his physical injury, $10,000 for his loss of income, and $50,000 punitive damages. As a result of the award, the amount Olaf must include in gross income is: a. $10,000. b. $50,000. c. $60,000. d. $85,000. e. None of the above. ____ 80. Julie was suffering from a viral infection that caused her to miss work for 90 days. During the first 30 days of her absence, she received her regular salary of $5,000 from her employer. For the next 60 days, she received $10,000 under an accident and health insurance policy that she had purchased for payments totaling $6,000. Of the $15,000 she received, Julie must include in gross income: a. $0. b. $4,000. c. $5,000 d. $9,000. e. None of the above. 12

Name: ________________________

ID: A

____ 81. Matilda works for a company with 1,000 employees. The company has a hospitalization insurance plan that covers all employees. However, the employee must pay the first $3,000 of his or her medical expenses each year. Each year the employer contributes $1,500 to each employee’s health savings (HSA). Matilda’s employer made the contributions in 2005 and 2006, and the earned $100 interest in 2006. At the end of 2006, Matilda withdrew $2,100 from the to pay the deductible portion of her medical expenses for the year. As a result, Matilda must include in her 2006 gross income: a. $0. b. $100. c. $1,600. d. $2,100. e. None of the above. ____ 82. All employees of Mauve Company are covered by a group hospitalization insurance policy, but the employees must pay the s (which are withheld from the employee’s wages). None of the employees have sufficient medical expenses to deduct them as an itemized deduction. If the employer reduced each employee’s pay by the cost of the insurance and the employer paid the s: a. All of the employees’ income after tax and insurance cost would increase. b. Only the high income (35% marginal tax bracket) employees would benefit. c. Only the low income (10% and 15% marginal tax bracket) employees would benefit. d. All of the employees’ income after tax and insurance cost would remain the same. e. None of the above. ____ 83. The plant union is negotiating with the Eagle Company, which is on the verge of bankruptcy. Eagle has offered to pay for the employees’ hospitalization insurance in exchange for a wage reduction. The employees each currently pay s of $4,000 a year for their insurance. a. If an employee’s wages are reduced by $5,000 and the employee is in the 28% marginal tax bracket, the employee would benefit from the offer. b. If an employee’s wages are reduced by $4,000 and the employee is in the 15% marginal tax bracket, the employee would benefit from the offer. c. If an employee’s wages are reduced by $6,000 and the employee is in the 35% marginal tax bracket, the employee would benefit from the offer. d. a., b., and c. e. None of the above. ____ 84. James, a cash basis taxpayer, received the following compensation and fringe benefits in 2006: Salary Disability income protection s Long-term care insurance s

$66,000 3,000 4,000

James did not receive in 2006 $6,000 of his $72,000 salary because in December 2005 his employer advanced him $6,000 on his 2006 salary. The employer made the salary advance so that James could pay his son’s college tuition that was due in December 2005. The wage continuation insurance is available to all employees and pays the employee three-fourths of the regular salary if the employee is sick or disabled. The long-term care insurance is available to all employees and pays $150 per day towards a nursing home or similar facility. What is James’s gross income from the above? a. $66,000. b. $72,000. c. $75,000. d. $76,000. e. None of the above. 13

Name: ________________________

ID: A

____ 85. The First Chance Casino has gambling facilities, a bar, a restaurant, and a hotel. All employees are allowed to obtain food from the restaurant at no charge during working hours. In the case of the employees who operate the gambling facilities, bar, and restaurant, 60% of all of Casino’s employees, the meals are provided for the convenience of the Casino. However, the hotel workers, demanded equal treatment and therefore were also allowed to eat in the restaurant at no charge while they are at work. Which of the following is correct? a. All the employees are required to include the value of the meals in their gross income. b. Only the restaurant employees may exclude the value of their meals from gross income. c. Only the employees who work in gambling, the bar, and the restaurant may exclude the meals from gross income. d. All of the employees may exclude the value of the meals from gross income. e. None of the above. ____ 86. Section 119 excludes the value of meals from the employee’s gross income: a. Whenever the employer pays for the meal and for the convenience of the employee. b. When the meals are provided for the employee on the employer’s premises as a convenience to the employee. c. When the meals are provided for the employee on the employer’s premises for the convenience of the employer. d. All of the above. e. None of the above. ____ 87. Robin, a senior at State University, receives free room and board as full compensation for working as a resident advisor at the university dormitory. The regular housing contract is $1,400 a year total, $800 for lodging and $600 for meals in the dormitory. What is Robin’s gross income from this employment? a. $0, the entire value of the contract is excluded, assuming the meals are provided for the convenience of the employer. b. $600, the meal contract must be included in gross income. c. $800, the lodging contract must be included in gross income. d. $1,400, the entire value of the contract is compensation. e. None of the above. ____ 88. Under the Swan Company’s cafeteria plan, all full-time employees are allowed to select any combination of the benefits below, but the total received by the employee cannot exceed $8,000 a year. I. II. III. IV.

Group medical and hospitalization insurance for the employee, $3,600 a year. Group medical and hospitalization insurance for the employee’s spouse and children, $1,200 a year. Child-care payments, actual cost but not more than $4,800 a year. Cash required to bring the total of benefits and cash to $8,000.

Which of the following statements is true? a. Sam, a full-time employee, selects choices II and III and $2,000 cash. His gross income must include the $2,000. b. Paul, a full-time employee, elects to receive $8,000 cash because his wife’s employer provided these same insurance benefits for him. Paul is required to include the $8,000 in gross income. c. Sue, a full-time employee, elects to receive choices I, II and $3,200 for III. Sue is not required to include any of the above in gross income. d. All of the above. e. None of the above.

14

Name: ________________________

ID: A

____ 89. The president of Silver Corporation is assigned a secretary. When the secretary has completed work on company matters, the secretary is available to do the president’s personal matters (pick up laundry, buy groceries) so long as the privilege is not abused. No other employee has a personal secretary. a. The value of the secretary’s services provided to the president may be excluded as no-additional-cost services. b. The value of the secretary’s services provided to the president may be excluded because the president did not receive cash. c. The value of the secretary’s services provided to the president may be excluded as no-additional-cost services because the services are not available to all employees. d. If the value of secretary’s services are considered de minimis, the president may exclude the benefit from gross income even through other employees are not provided the same benefit. e. None of the above. ____ 90. Veneia’s employer pays for her automobile parking space that she uses while she is at work ($100 per month). a. Veneia can exclude the cost of the parking from income even though not all employees receive a free parking space (that is, even though the plan is discriminatory). b. Veneia is allowed to exclude the cost of the parking space from income because if the employer did not pay for the space, Veneia could deduct her cost. c. Veneia must include the cost of the parking space in gross income. d. All of the above. e. None of the above. ____ 91. In the case of a fringe benefit plan that is discriminatory (e.g., the plan favors officers over other employees), a. All employees must include all benefits received in gross income. b. De minimis fringes may be excluded from gross income. c. The value of a parking space provided (value of $100 per month) must be included in gross income. d. Those who are being discriminated against can exclude a certain portion of their cash compensation from gross income to achieve parity. e. None of the above. ____ 92. A U.S. citizen worked in a foreign country for the period November 1, 2005, through December 31, 2006. Her salary was $10,000 per month. Also, in 2006 she received $5,000 in dividends from foreign corporations (not qualified dividends). a. The taxpayer can exclude $20,000 from U.S. gross income for 2005 because the salary was less than the annual foreign earned income exclusion. b. The taxpayer can exclude all of the income from U.S. gross income in 2005 and 2006 because the income was earned in a foreign country. c. The taxpayer can exclude from U.S. gross income a portion of the salary in 2005 and 2006, but none of the dividends can be excluded. d. The taxpayer can exclude a portion of the salary from U.S. gross income in 2005 and 2006, and can exclude all of the dividends received in 2006. e. None of the above.

15

Name: ________________________

ID: A

____ 93. Harriet had the following interest income for the year: Interest on state income tax refund Interest on Montgomery County bonds Interest on United States government bonds

$ 500 2,800 900

In addition, Harriet had a $500 gain from the sale of the Montgomery County bonds. Harriet’s gross income is: a. $4,700. b. $1,900. c. $1,400. d. $500. e. None of the above. ____ 94. Harry and Wanda received the following interest income in the current year: Savings United States Treasury bonds Interest on Federal tax refund Interest on State income tax refund

$3,000 300 100 50

The bank gave Harry and Wanda a cellular phone (worth $70) for opening their savings . What amount of interest income should they report on their t income tax return? a. $3,520. b. $3,220. c. $3,170. d. $3,100. e. None of the above. ____ 95. Stuart owns 300 shares of Turquoise Corporation stock and 2,000 shares of Blue Corporation stock. During the year, Stuart received 150 shares of Turquoise as a result of a 1 for 2 stock split. The value of the shares received was $2,400. Stuart also received 100 shares of Blue Corporation stock as a result of a 5% stock dividend. Stuart did not have the option of receiving cash from Blue. The additional shares he received had a value of $3,600. Stuart’s gross income from the receipt of the additional Turquoise and Blue shares is: a. $0. b. $2,400. c. $3,600. d. $6,000. e. None of the above. ____ 96. Assuming a taxpayer qualifies for the exclusion treatment, the interest income on educational savings bonds: a. Is gross income to the person who purchased the bond in the year the interest is earned. b. Is gross income to the student in the year the interest is earned. c. Is included in the student’s gross income in the year the savings bonds are sold or redeemed to pay educational expenses. d. Is not included in anyone’s gross income if the proceeds are used to pay college tuition. e. None of the above.

16

Name: ________________________

ID: A

____ 97. The exclusion of interest on educational savings bonds: a. Applies only to savings bonds owned by the child. b. Applies to parents who purchase bonds for which the proceeds are used for their child’s education. c. Means that the child must include the interest in income is the bond is owned by the parent. d. Is phased out once the taxpayer’s adjusted gross income exceeds $50,000. e. None of the above. ____ 98. Martha participated in a qualified tuition program for the benefit of her son. She invested $5,000 in the fund. Four years later her son withdrew $7,500, the entire balance in the program, to pay his college tuition. a. Martha must include the $2,500 ($7,500 – $5,000) in her gross income when the funds are used to pay the tuition. b. Martha must include the portion of the $2,500 accumulated each year in her gross income (i.e., interest). c. Martha’s son must include the $2,500 ($7,500 – $5,000) in his gross income when the funds are used to pay the tuition. d. Martha’s son must include the portion of the $2,500 accumulated each year in his gross income (i.e., interest). e. None of the above. ____ 99. Hazel, a solvent individual but a recovering alcoholic, embezzled $5,000 from her employer. In the same year that she embezzled the funds, her employer discovered the theft. Her employer did not fire her and told her she did not have to repay the $5,000 if she would attend Alcoholics Anonymous. Hazel met the conditions and her employer cancelled the debt. a. Hazel did not realize any income because she obtained the funds illegally. b. Hazel is not required to include the $5,000 in gross income because her employer made a gift to her. c. Hazel must include $5,000 in gross income from discharge of indebtedness. d. Hazel may exclude the $5,000 from gross income because the debt never existed. e. None of the above. ____ 100. On January 1, 1996, Yellow corporation issued 6% 25-year bonds at par and used the $10,000,000 proceeds to finance the construction of a new plant. On January 1, 2006, the company acquired the bonds on the open market for $9,500,000. Assuming that Yellow Corporation is neither bankrupt nor insolvent, the acquisition and retirement of the bonds results in which of the following: a. The company must recognize a $500,000 gain. b. The company can make an election to recognize a $500,000 gain or reduce the company’s basis in the plant by $500,000. c. The company must recognize a $500,000 gain and increase the company’s basis in the plant by $500,000. d. The company can amortize the $500,000 gain, recognizing income over the remaining life of the bonds. e. None of the above.

17

ID: A

BUSA307 - Federal Taxation, Sample Exam 1 Chapters 1-5 Answer Section TRUE/FALSE 1. ANS: T Conversion from residential to rental use will increase the taxes. Furthermore, Julie’s mother may have had a senior citizen exemption on the property, which will no longer be appropriate. Lastly, the furnishings in the rent house could now be subject to an ad valorem tax on personalty. PTS: 1 REF: p. 1-6 to 1-8 2. ANS: F If Julius can obtain the consent of his wife to make the election to split the gifts, twelve per donee annual exclusions are available. PTS: 1 REF: p. 1-12 3. ANS: T Most often the due dates are the same (e.g., April 15). PTS: 1 REF: p. 1-15 4. ANS: F Interest rates are determined quarterly by the IRS. PTS: 1 REF: p. 1-21 5. ANS: T PTS: 1 6. ANS: F The justification is social and economic.

REF: Example 15

PTS: 1 REF: p. 1-26 | Footnote 27 7. ANS: F The seller is taxed in the year the installment payments are received. PTS: 1 REF: p. 1-29 8. ANS: F The major change was the reorganization and renumbering of the then tax provisions. PTS: 1 REF: p. 2-3 9. ANS: F Regular decisions generally involve novel issues not previously resolved by the Tax Court. Note, however, sometimes the issues in a Regular decision of the Tax Court are not novel. PTS: 1 10. ANS: F 11. ANS: F

REF: p. 2-17 PTS: 1 PTS: 1

REF: p. 2-17 REF: p. 2-24

1

ID: A 12. ANS: F Under the global system of taxation followed by the U.S., foreign-sourced income is subject to tax. Although Kim is not a citizen, he is a resident of the U.S. Global Tax Issues on p. 3-5 PTS: 1 REF: p. 3-5 13. ANS: T Less medical expenses can be deducted since the 7.5% of AGI floor will be larger. PTS: 1 REF: Example 4 14. ANS: T Being age 20, Darren cannot be a qualifying child unless he is a full-time student. As a qualifying child, he is exempt from the gross income test. PTS: 1 REF: p. 3-11 | p. 3-12 15. ANS: T Such stealth taxes as the phaseout of exemptions do not begin until taxpayers reach significant income levels. Tax in the News PTS: 1 REF: p. 3-19 16. ANS: F The child need not file only if the parental election (if available) picks up all of the child’s income. PTS: 1 REF: p. 3-24 17. ANS: T PTS: 1 REF: p. 3-26 18. ANS: T PTS: 1 REF: Example 41 19. ANS: T The accrual basis taxpayer cannot defer the income from the advance payments beyond the tax year following the year of receipt. PTS: 1 REF: p. 4-13 20. ANS: F George is allowed to deduct the alimony of $20,000 from his gross income and Erin includes the alimony of $20,000 in her gross income. Thus, the alimony rules tax the person who benefits from the income rather than the person who earned the income. PTS: 1 REF: p. 4-20 21. ANS: T The lender is treated as though he or she charged interest and then forgave the borrower from paying the interest. PTS: 1 REF: p. 4-23 | Concept Summary 4-2 22. ANS: T At the end of the 12th year, Susan’s basis for the annuity is $0. PTS: 1

REF: p. 4-29

2

ID: A 23. ANS: F By transferring the prize to one of the qualified groups, it is not included in the gross income of the winner. However, there is no relationship between the amount of the exclusion and the taxpayer’s AGI. PTS: 1 REF: p. 4-31 24. ANS: T Norma’s earned income of $27,000 plus 50% of her Social Security benefits of $4,500 ($9,000 50%) exceed the threshold amount of $25,000. PTS: 1 REF: p. 4-33 25. ANS: F Worker’s compensation benefits are excludible from gross income. PTS: 1

REF: p. 5-12

MULTIPLE CHOICE 26. ANS: A PTS: 1 REF: p. 1-3 | p. 1-4 27. ANS: E All choices listed (a. to d.) describe taxes that are proportional. PTS: 1 REF: p. 1-5 | Example 2 28. ANS: A With the expiration of the tax holiday, the full ad valorem tax can now be imposed (choice a.). State owned property is exempt from tax (choice b.). As church owned and educational use property is usually exempt, choice c. will have no effect, and choice d. will reduce tax revenues. PTS: 1 REF: p. 1-6 | p. 1-7 29. ANS: E A use tax is a complement to a general sales tax. Consequently, it is not imposed by all states because a few states do not have a general sales tax. At this point, the Federal government has no general sales tax. PTS: 1 REF: p. 1-9 30. ANS: A The per donee annual exclusion is only available for gift tax purposes (choice a.). Ideally, gifts should involve property that is expected to appreciate in value (choice b.). A higher unified tax credit is available for estate tax purposes (choice c.). Usually the donor is trying to shift future income to lower bracket donees (choice d.). PTS: 1 REF: p. 1-12 31. ANS: E Many states piggyback to the Federal system (choice a.). Some states, due to revenue shortfalls, have decoupled from various provisions of the Federal version (choice b.). The “jock tax,” although much criticized, is very much in being (choice c.). Some states even have had more than one amnesty period (choice d.). PTS: 1

REF: p. 1-14 | p. 1-15

3

ID: A 32. ANS: B FICA is imposed on both the employer and the employee (choice a.). Children who work for parents are not exempt from the tax unless under age 18 (choice b.). Its objective is retirement income, not loss of employment (choice c.). It is istered only by the Federal government (choice d.). PTS: 1 REF: p. 1-15 | p. 1-16 33. ANS: A There is only a single rate. The tax base is simplified by taxing only limited types of income. Many deductions and credits would be eliminated. PTS: 1 REF: p. 1-17 34. ANS: C The number of returns audited by the IRS has significantly decreased (choice a.). An office audit takes place at the office of the IRS (choice b.). The participation of a special agent occurs when fraud is suspected-the type of audit involved is immaterial (choice d). PTS: 1 REF: p. 1-18 to 1-20 35. ANS: C Following the procedure set forth in Example 15, the penalty is determined as follows: Failure to pay penalty [1/2% $6,000 3 (three months violation)] Plus: Failure to file penalty [5% $6,000 3 (three months violation)] $900 Less: Failure to pay penalty (90) Total penalties

36. 37. 38. 39.

PTS: ANS: ANS: ANS: ANS:

1 C B A C

REF: PTS: PTS: PTS: PTS:

Example 15 1 1 1 1

REF: REF: REF: REF:

4

p. 2-2 | p. 2-3 p. 2-8 | p. 2-30 | Exhibit 2-1 Exhibit 2-1 Concept Summary 2-1

$ 90

810 $900

ID: A 40. ANS: C USTCs report decisions of the U.S. District Courts, Court of Federal Claims, Circuit Court of Appeals, and the Supreme Court. They do not report the decisions of the U.S. Tax Court. West’s F. 2d series reports the decisions of the U.S. Claims Court (before October 1982) and the Circuit Courts of Appeal. They do not report the decisions of the U.S. Tax Court, U.S. District Courts, and the Supreme Court. In the light of these conditions, what are the possibilities.

Choice a. is not possible, since there is no appeal from the Small Cases Division of the U.S. Tax Court. Choice b. is not possible because the USTC series does not contain the decision of the U.S. Tax Court. Choice d. is not possible since an appeal from the Circuit Court of Appeals would have been to the U.S. Supreme Court.

What the citation represents, therefore, is the affirmation of an appeal of a U.S. District Court decision (reported in the USTCs) by a Circuit Court of Appeals (reported in the F.2d series), or choice c. PTS: 1 REF: p. 2-19 | p. 2-20 | Concept Summary 2-2 41. ANS: E The U.S. Tax Court has 19 regular judges; the U.S. Court of Federal Claims has 16; and the U.S. Supreme Court has nine. PTS: 1 REF: Concept Summary 2-1 42. ANS: A The T.C.Memo. Citation (choice a.) refers to a memorandum decision of the U.S. Tax Court. CCH’s U.S. Tax Cases series (USTC in choice b.) does not include decisions of the U.S. Tax Court. The same holds true of RIA’s American Federal Tax Report (AFTR2d in choice c.). PTS: 1 REF: p. 2-18 | Concept Summary 2-2 43. ANS: B PTS: 1 REF: Concept Summary 2-1 | Figure 2-3 44. ANS: A Union dues (choice b.) and tax return preparation fee (choice d.) are deductions from AGI. Child payments (choice c.) are nondeductible expenses. PTS: 1 REF: p. 3-5 | Exhibit 3-3 45. ANS: D $60,000 (salary) + $50,000 (punitive damages) + $2,000 (cash dividends) = $112,000. The damages from personal injury and the municipal bond interest are nontaxable exclusions. PTS: 1 REF: Example 2 | Exhibit 3-1 | Exhibit 3-2 46. ANS: A Toby’s standard deduction of $1,000 ($700 + $300) completely negates his gross income of $700. The interest of $1,000 on the City of Omaha bonds is nontaxable. PTS: 1

REF: p. 3-9 | Exhibit 3-1

5

ID: A 47. ANS: C A qualifying child can be a nonresident alien under the adopted child exception (choice a.). The filing of a t return is not fatal if filing is not required and its purpose is to obtain a tax refund (choice b.). A cousin does not meet the relationship test (choice c.). A temporary absence is permissible under the domicile test (choice d.). A grandson meets the relationship test, and disability waives the age test (choice e.). PTS: 1 REF: p. 3-11 | p. 3-12 | p. 3-16 48. ANS: A Kyle, who filed a t return in 2003, was entitled to file as a surviving spouse in 2004 and 2005. In 2006, he will be entitled to file as a head of household. PTS: 1 REF: Example 38 49. ANS: E As the executor, it is unlikely that she would refuse to consent to a t return. Since she is deemed married in the year of her husband’s death, she cannot file as single (choice a.) or head of household (choice d.). She does not qualify for surviving spouse status until the next year (i.e., 2007). PTS: 1 REF: p. 3-30 50. ANS: D Wilma meets the “abandoned spouse” rules. Therefore, she can file as a head of household. Otherwise, her filing status would be married, filing separately. PTS: 1 REF: p. 3-31 51. ANS: C The loss on the business auto of $1,000 is an ordinary loss, while the loss on the stock investment of $1,000 is a capital loss. The loss on the yacht of $1,000 is personal and, therefore, cannot be deducted. PTS: 1 REF: p. 3-33 | Example 43 | Example 44 52. ANS: A Collectibles are taxed at a maximum of 28%, while long-term capital gains are subject to a top rate of 15%. Short-term capital gains are treated the same as ordinary income. PTS: 1 REF: p. 3-33 53. ANS: A Collectibles and short-term capital gains are taxed at Joan’s regular 15% tax bracket, while long-term capital gains are subject to a rate of 5%. PTS: 1 REF: p. 3-33 54. ANS: D First, the STCG and STCL are combined, resulting in a STCL of $3,000. Of this STCL, $1,000 is applied against the collectible gain of $1,000, and the $2,000 balance is applied against the LTCG of $3,000. The result is a LTCG of $1,000. PTS: 1 REF: Example 47 55. ANS: E Able Corporation must include the $2,000,000 in gross income. PTS: 1

REF: p. 4-8 | p. 4-9 6

ID: A 56. ANS: D The constructive receipt doctrine does not apply to the negotiations. Therefore, Turner will include the salary and bonus in his gross income in the tax year received in accordance with the negotiated contract. PTS: 1 REF: p. 4-10 57. ANS: C The increase in value is not subject to tax because the “substantial restrictions” on payments (you must cancel coverage) prevents application of the constructive receipt doctrine. See the discussion preceding Example 13. PTS: 1 REF: p. 4-9 | p. 4-10 58. ANS: C The company is required to recognize the $1,000 (December and January rent) because prepaid income from rents is ineligible for deferral. The damage deposit is not income. PTS: 1 REF: p. 4-12 | p. 4-13 59. ANS: D One-eighth (3/24) of the payments on the two-year contracts were earned (1/8 $72,000 = $9,000) and one-fourth (1/4 $64,000 = $16,000) of the payments on the one-year contracts were earned in 2006 and is included in 2006 gross income. The balance of the payments of $111,000 ($136,000 – $9,000 – $16,000) must be included in 2007 gross income. PTS: 1 REF: p. 4-13 60. ANS: A The cost of the bond was $2,750 ($3,200 – $450 accrued interest). The sales price was $2,400 ($2,800 – $400 accrued interest). Therefore, Theresa’s loss from the sale is $350 ($2,400 – $2,750). In addition, Theresa must include $400 of accrued interest in her gross income. PTS: 1 REF: p. 4-14 | Example 22 61. ANS: A Because Jim and Nora lived apart for the entire year, she does not have to report one-half of Jim’s salary on her separate return. She is required to report her share of the income from the community owned investments. PTS: 1 REF: p. 4-17 to 4-19 62. ANS: B PTS: 1 REF: p. 4-21 to 4-23 63. ANS: C The $1,500 per month ($18,000) for child is not deductible by Kim. The alimony of $4,000 per month ($48,000) is deductible by Kim. PTS: 1 REF: p. 4-20 | Example 32 | Concept Summary 4-1 64. ANS: A $3,000 12 = $36,000. The remaining $2,000 per month is child because of the contingency relative to Jack’s child. PTS: 1

REF: p. 4-23

7

ID: A 65. ANS: A The corporation made a compensation related loan. It has imputed interest income and compensation expense. The employee has imputed interest expense and compensation income. Since the loan is for $450,000, the $10,000 exception does not apply. PTS: 1 REF: p. 4-23 to 4-27 66. ANS: D Jay is collecting under an annuity contract and the cost must be allocated among the payments received on the basis of the cost/expected return, until the total cost has been recovered. Thus, for each annuity payment received for the 150-month period, $200 ($1,000 20%) is excluded from gross income and $800 ($1,000 80%) is included in gross income. Any payments received after the 150-month period is included in his gross income. PTS: 1 REF: p. 4-27 to 4-30 67. ANS: D The plan is discriminatory. Therefore, the employee’s income is the greater of the amount from the IRS table ($8 200 = $1,600) or the employer’s cost ($2,800). PTS: 1 REF: p. 4-32 68. ANS: B When Tom receives $1,000 income, this may mean that Tom must include an additional $500 of Social Security benefits in his gross income. If the marginal tax rate is 15%, his additional tax could be as much as $225 ($1,500 15%). PTS: 1 REF: p. 4-33 | p. 4-34 69. ANS: B Because gains and losses are not recognized until realization has occurred, the taxpayer should sell depreciated assets (i.e., basis exceeds fair market value) and deduct any loss. The taxpayer should hold the appreciated assets (i.e., basis is less than fair market value) and, thus, defer gain. PTS: 1 REF: p. 4-35 70. ANS: A See the discussion of Comm. v. Duberstein. PTS: 1 REF: p. 5-5 71. ANS: B The interest element of $50,000 ($150,000 – $100,000) is included in Carin’s gross income. PTS: 1 REF: p. 5-6 to 5-9 72. ANS: D Swan has a basis in the receivable of $1,000, since it is an accrual method taxpayer. PTS: 1 REF: p. 5-7 73. ANS: D The redemption of the policy by Ted qualifies as an accelerated death benefit. Thus, the realized gain is excluded from his gross income. PTS: 1

REF: p. 5-7 | p. 5-8 8

ID: A 74. ANS: B $2,200 ($1,700 interest + $500 prize). PTS: 1 REF: Exhibit 5-1 | p. 5-9 75. ANS: C The tuition waiver of $5,500 and the monthly stipend of $500 (for 9 months = $4,500) for research are taxable compensation. The research grant of $2,000 is to assist him in his education and is not in exchange for services; therefore, the grant is a nontaxable scholarship. PTS: 1 REF: p. 5-9 76. ANS: E Sally must include in gross income the $150,000 of punitive damages received and the $6,000 recovery of medical expenses that were deducted in 2005. PTS: 1 REF: p. 5-11 | p. 5-12 | p. 5-31 77. ANS: D The $5,000 Mike received under the company’s sick pay plan must be included in his gross income. Note that if the $5,000 had been received in a damage settlement, it could be excluded from gross income. PTS: 1 REF: p. 5-11 to 5-14 78. ANS: D The punitive damages of $50,000 must be included in his gross income. In addition, since the compensatory damages of $100,000 are not for physical personal injury or physical sickness, they must be included in his gross income. PTS: 1 REF: p. 5-11 | p. 5-12 79. ANS: B Punitive damages are never excluded from gross income. PTS: 1 REF: p. 5-11 | p. 5-12 80. ANS: C The $10,000 received under the accident and health insurance policy Julie purchased is excluded from her gross income. PTS: 1 REF: p. 5-13 | p. 5-14 81. ANS: A With the health savings (HSA), the employee is not taxed when the money is contributed, as income is earned in the , nor when amounts are withdrawn to pay medical expenses. PTS: 1 REF: p. 5-14 | p. 5-15 82. ANS: A Each employee’s income, less taxes and insurance, would increase by the cost of insurance times the employee’s marginal tax rate. PTS: 1

REF: p. 5-13 to 5-15

9

ID: A 83. ANS: D In all three cases, the reduction in after-tax pay of the employee will be less than the $4,000 value of the nontaxable insurance s to be paid by the employer.

a. b. c.

Reduction in Pay $5,000 $4,000 $6,000

Marginal Tax Rate 0.28 0.15 0.35

Reduction in Tax $1,400 $ 600 $2,100

Reduction in After-tax Income $3,600 $3,400 $3,900

PTS: 1 REF: p. 5-13 | p. 5-33 | p. 5-34 84. ANS: A The $6,000 salary advance was taxed in 2005 when the cash basis taxpayer received it. The disability income protection and long-term care insurance s are excluded from gross income. PTS: 1 REF: Exhibit 5-1 | p. 5-13 | p. 5-14 85. ANS: D For more than 50% of the employees, the meals are furnished for the convenience of the employer; therefore, all of the meals are excludible. PTS: 1 REF: p. 5-15 to 5-17 86. ANS: C PTS: 1 REF: p. 5-15 to 5-17 87. ANS: A The meals and lodging are provided for the convenience of the employer. PTS: 1 REF: p. 5-15 to 5-17 88. ANS: D PTS: 1 REF: p. 5-19 | Example 23 89. ANS: D Answers a. and c. are incorrect because the no-additional-cost services must be provided to all employees to qualify for the exclusion. Answer b. is incorrect because the receipt of noncash items (e.g., services, other property) can produce gross income. PTS: 1 REF: p. 5-20 to 5-25 90. ANS: A As a qualified transportation fringe, the benefit can be granted on a discriminatory basis and still qualify for the exclusion. PTS: 1 REF: p. 5-23 91. ANS: B De minimis fringe benefits can be excluded, even if discriminatory, because the potential amount of income at issue is small relative to the cost of ing for those benefits. PTS: 1

REF: p. 5-23 | Concept Summary 5-2

10

ID: A 92. ANS: C Answer a. is incorrect because the available exclusion for 2005 is less than $20,000. Answer b. is incorrect because the annual statutory limit on the foreign earned income exclusion is $80,000. Answer d. is incorrect because the dividends received cannot be excluded from gross income. PTS: 1 REF: p. 5-26 | p. 5-27 93. ANS: B Interest on Montgomery County school bonds is excluded under § 103. Gross income is $1,900 (i.e., $500 + $900 + $500). PTS: 1 REF: p. 5-27 | p. 5-28 94. ANS: A All of the amounts ($3,520) represent interest payments and are included in Harry and Wanda’s gross income. PTS: 1 REF: p. 5-27 | p. 5-28 | Exhibit 5-1 95. ANS: A Neither the stock dividend nor the stock split is taxable. PTS: 1 REF: p. 5-29 96. ANS: D PTS: 1 REF: p. 5-29 | p. 5-30 97. ANS: B PTS: 1 REF: p. 5-29 | p. 5-30 98. ANS: E Under a qualified tuition program, neither the beneficiary of the income (the son) nor the owner (Martha) of the property includes the earnings in gross income as long as the funds are used to pay qualified tuition. PTS: 1 REF: p. 5-30 | p. 5-31 99. ANS: C Even if the employer had intended that a gift be made, § 102(c) prohibits exclusion treatment. Hazel realized a $5,000 increase in her net worth as a result of the theft and the subsequent cancellation of the debt. PTS: 1 100. ANS: A

REF: p. 5-32 | p. 5-33 PTS: 1 REF: p. 5-32 | p. 5-33

11

ID: A

BUSA307 - Federal Taxation, Sample Exam 1 Chapters 1-5 True/False Indicate whether the statement is true or false. ____

1. Julie inherits her mother’s personal residence, which she converts to a furnished rent house. This change should affect the amount of ad valorem property taxes levied on the properties.

____

2. Julius, a married taxpayer, makes gifts to each of his six children. Only six per donee annual exclusions will be allowed as to these gifts.

____

3. The due dates for filing state income tax returns most often are the same as the due date of the Federal income tax return.

____

4. The IRS is required to redetermine the interest rate on underpayments and overpayments once a year.

____

5. During any month in which both the failure to file penalty and the failure to pay penalty apply, the failure to file penalty is reduced by the amount of the failure to pay penalty.

____

6. The tax law provides various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education. These provisions can be justified on both economic and equity grounds.

____

7. As it is consistent with the wherewithal to pay concept, the tax law permits a seller to recognize gain in the year the installment sale took place.

____

8. The 1954 Code codification substantially changed the tax law existing on the date of its enactment.

____

9. Regular decisions of the Tax Court generally involve novel issues previously resolved by the U.S. Tax Court.

____ 10. The following citation cannot be correct: Jack D. Carr, T.C. Memo. 1985-19. ____ 11. Online research systems are generally less costly than CD-ROM services. ____ 12. Kim, a citizen of Korea, is a resident of the U.S. Any income Kim receives from land he owns in Korea is not subject to the U.S. income tax. ____ 13. An increase in the amount of a taxpayer’s AGI can reduce the amount of medical expenses allowed as a deduction. ____ 14. Darren, age 20 and not disabled, earns $4,500 during 2006. Darren’s parents cannot claim him as a dependent unless he is a full-time student. ____ 15. Stealth taxes are directed at higher income taxpayers. ____ 16. When the kiddie tax applies, the child need not file an income tax return as the child’s income will be reported on the parents’ return. ____ 17. Regardless of the standard deduction and exemption amounts, a self-employed individual with net earnings of $400 or more from a business or profession must file a Federal income tax return. ____ 18. In 2006, Tony is a widower and maintains a household in which he and his unmarried daughter, Marie, live. If Marie is not Tony’s dependent, he cannot claim head of household filing status. ____ 19. On June 30, 2006, an accrual basis taxpayer sold a contract to provide the same service each month for 36 months, July 2006 through June 2009. The contract price received was $3,600. The taxpayer may recognize $600 gross income in 2006 and $3,000 in 2007. 1

Name: ________________________

ID: A

____ 20. George and Erin are divorced, and George is required to pay Erin $20,000 of alimony each year. George earns $75,000 a year. Erin is not required to include the alimony payments in gross income because George earned the income and therefore he should pay the tax on the income. ____ 21. In the case of a below-market gift loan for which there is no exception to the imputed interest rules, the lender must recognize imputed interest income. ____ 22. Susan purchased an annuity for $120,000. She is to receive $15,000 each year and her life expectancy is 12 years. If Susan collects under the annuity for 13 years, the entire $15,000 received in the 13th year must be included in her gross income. ____ 23. If a Nobel peace prize winner transfers the prize to a qualified government unit or nonprofit organization, then the prize is excluded from the winner’s gross income if the amount of the prize does not exceed 50% of the winner’s AGI. ____ 24. Norma’s income for 2006 is $27,000 from part-time work and $9,000 of Social Security benefits. Norma is not married. A portion of her Social Security benefits must be included in her gross income. ____ 25. Sam received $25,000 of salary, interest, and dividends in 2006. He also received $10,000 as worker’s compensation benefits. Sam must include either 50% or 85% of the worker’s compensation benefits in gross income for 2006. Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 26. Which, if any, of the following statements best describes the history of the Federal income tax? a. It existed during the Civil War. b. The Federal income tax on corporations was held by the U.S. Supreme Court to be contrary to the U.S. Constitution. c. The Federal income tax on individuals was held by the U.S. Supreme Court to be allowable under the U.S. Constitution. d. Both the Federal income tax on individuals and on corporations was held by the U.S. Supreme Court to be contrary to the U.S. Constitution. e. None of the above. ____ 27. Which, if any, of the following taxes is progressive (rather than proportional)? a. A city’s excise tax on hotel occupancy. b. Medicare component of FICA and FUTA. c. Federal gas guzzler tax. d. Value added taxes. e. None of the above. ____ 28. Which, if any, of the following occurrences will increase a taxing jurisdiction’s revenue from ad valorem taxes imposed on real estate? a. A tax holiday expires. b. The state condemns farmland for a prison facility. c. A church builds a school on vacant land it already owns. d. An apartment building is acquired by a university for use as a dormitory.. e. None of the above.

2

Name: ________________________

ID: A

____ 29. A use tax is imposed by: a. The Federal government and all states. b. The Federal government and a majority of the states. c. A minority of the states and not the Federal government. d. All states and not the Federal government. e. None of the above. ____ 30. Property can be transferred within the family group by gift or at death. One motivation for preferring the gift approach is: a. To take advantage of the per donee annual exclusion. b. To avoid a future decline in value of the property transferred. c. To take advantage of the higher unified transfer tax credit available under the gift tax. d. To shift income to higher bracket donees. e. None of the above. ____ 31. State income taxes can: a. Piggyback to the Federal version. b. Decouple from the Federal version. c. Apply to visiting nonresidents. d. Provide occasional amnesty programs. e. All of the above. ____ 32. A characteristic of FICA is that: a. It is imposed only on the employer. b. It applies when a 19-year-old son works for his parents. c. It provides a modest source of income in the event of loss of employment. d. It is istered by both state and Federal governments. e. None of the above. ____ 33. The proposed flat tax: a. Would simplify the income tax. b. Would eliminate the income tax. c. Would tax the increment in value as goods move through the production and manufacturing stages to the marketplace. d. Is a tax on consumption. e. None of the above. ____ 34. Which of the following is characteristic of the IRS audit procedure? a. The percentage of individual income tax returns that the IRS audits has significantly increased over the years. b. An office audit takes place at the office of the taxpayer. c. One of the factors that leads to an audit is the information provided by informants. d. Only IRS special agents can conduct field audits. e. None of the above. ____ 35. Aidan files his tax return 65 days after the due date. Along with the return, Aidan remits a check for $6,000 which is the balance of the tax owed. Disregarding the interest element, Aidan’s total failure to file and to pay penalties are: a. $90. b. $810. c. $900. d. $990. e. None of the above.

3

Name: ________________________

ID: A

____ 36. The Internal Revenue Code was codified for the first time in what year? a. 1913. b. 1923. c. 1939. d. 1954. e. 1986. ____ 37. Which of the following types of Regulations has the highest tax validity? a. Temporary. b. Legislative. c. Interpretative. d. Procedural. e. None of the above. ____ 38. In assessing the importance of a regulation, an IRS agent must: a. Give equal weight to the Code and regulations. b. Give more weight to the Code rather than to a regulation. c. Give more weight to the regulation rather than to the Code. d. Give less weight to the Code rather than to a regulation. e. None of the above. ____ 39. If a taxpayer decides not to pay a tax deficiency, he or she must go to which court? a. Appropriate U.S. Circuit Court of Appeals. b. U.S. District Court. c. U.S. Tax Court. d. U.S. Court of Federal Claims. e. None of the above is available. ____ 40. Interpret the following citation: 64-1 USTC ¶9618, aff’d in 344 F. 2d 966. a. A U.S. Tax Court Small Cases Division decision that was affirmed on appeal. b. A U.S. Tax Court decision that was affirmed on appeal. c. A U.S. District Court decision that was affirmed on appeal. d. A U.S. Circuit Court of Appeals decision that was affirmed on appeal. e. None of the above. ____ 41. Court(s) with more than one judge include: a. U.S. Court of Federal Claims. b. U.S. Tax Court. c. U.S. Supreme Court. d. Only b. and c. e. a., b., and c. ____ 42. A Memorandum decision of the U.S. Tax Court could be cited as: a. T.C.Memo. 1990-650. b. 68-1 USTC ¶9200. c. 37 AFTR2d 456. d. All of the above. e. None of the above.

4

Name: ________________________

ID: A

____ 43. A taxpayer who loses in the U.S. Court of Federal Claims may appeal directly to which court? a. Supreme Court. b. Federal Circuit Court of Appeals. c. U.S. Court of Appeals for the District of Columbia. d. U.S. Tax Court. e. None of the above. ____ 44. Which, if any, of the following items is a deduction for AGI? a. Moving expenses. b. Union dues. c. Child payments. d. Tax return preparation fee. e. None of the above. ____ 45. During 2006, Margaret had the following transactions: Salary Interest income on City of Albuquerque bonds Damages for personal injury (car accident) Punitive damages (same car accident) Cash dividends from General Electric stock

$60,000 1,000 30,000 50,000 2,000

Margaret’s AGI is: a. $60,000. b. $62,000. c. $92,000. d. $112,000. e. $142,000. ____ 46. Toby, age 15, is claimed as a dependent by his grandmother. During 2006, Toby had interest income from City of Omaha bonds of $1,000 and earnings from a part-time job of $700. Toby’s taxable income is: a. $0. b. $1,700 – $700 – $850 = $150. c. $1,700 – $1,000 = $700. d. $1,700 – $850 = $850. e. None of the above. ____ 47. A qualifying child cannot include: a. A nonresident alien. b. A married son who files a t return. c. A cousin. d. A daughter who is away at college. e. A grandson who is 28 years of age and disabled. ____ 48. Kyle, whose wife died in December 2003, filed a t tax return for 2003. He did not remarry, but has continued to maintain his home in which his two dependent children live. What is Kyle’s filing status as to 2006? a. Head of household. b. Surviving spouse. c. Single. d. Married filing separately. e. None of the above.

5

Name: ________________________

ID: A

____ 49. Emily, whose husband died in December 2006, maintains a household in which her dependent daughter lives. Which (if any) of the following is her filing status for the tax year 2006? (Note: Emily is the executor of her husband’s estate.) a. Single. b. Married, filing separately. c. Surviving spouse. d. Head of household. e. Married, filing tly. ____ 50. Wilma is married to Herb, who abandoned her in 2004. She has not seen or communicated with him since June of that year. She maintains a household in which she and her two dependent children live. Which of the following statements about Wilma’s filing status in 2006 is correct? a. Wilma can use the rates for single taxpayers. b. Wilma can file a t return with Herb. c. Wilma can file as a surviving spouse. d. Wilma can file as a head of household. e. None of the above statements is true. ____ 51. During the year, Kim sold the following assets: business auto for a $1,000 loss, stock investment for a $1,000 loss, and pleasure yacht for a $1,000 loss. Presuming adequate income, how much of these losses may Kim claim? a. $0. b. $1,000. c. $2,000. d. $3,000. e. None of the above. ____ 52. Perry is in the 33% tax bracket. During 2006, he had the following capital asset transactions: Gain from the sale of a stamp collection (held for 10 years) Gain from the sale of an investment in land (held for 4 years) Gain from the sale of stock investment (held for 8 months)

$30,000 10,000 4,000

Perry’s tax consequences from these gains are as follows: a. (15% $10,000) + (28% $30,000) + (33% $4,000). b. (15% $30,000) + (33% $4,000). c. (5% $10,000) + (28% $30,000) + (33% $4,000). d. (15% $40,000) + (33% $4,000). e. None of the above. ____ 53. Joan is in the 15% tax bracket and had the following capital asset transactions during 2006: Long-term gain from the sale of a coin collection Long-term gain from the sale of a land investment Short-term gain from the sale of a stock investment Joan’s tax consequences from these gains are as follows: a. (5% $10,000) + (15% $13,000). b. (5% $10,000) + (28% $11,000) + (15% $2,000). c. (15% $13,000) + (28% $11,000). d. (15% $23,000). e. None of the above. 6

$11,000 10,000 2,000

Name: ________________________

ID: A

____ 54. During 2006, Gerald has the following capital transactions: LTCG Long-term collectible gain STCG STCL

$3,000 1,000 2,000 5,000

After the netting process, the following results: a. Long-term collectible gain of $1,000. b. LTCG of $3,000, Long-term collectible gain of $1,000, and a STCL of $3,000. c. LTCG of $3,000, Long-term collectible gain of $1,000, and a STCL carryover to 2007 of $3,000. d. LTCG of $1,000. e. None of the above. ____ 55. Able Corporation sued Baker Corporation for intentional damage to Able’s goodwill. Able had created its goodwill through providing high-quality services to its customers. Thus, no basis for the goodwill appeared on Able’s balance sheet. The suit was settled and Able received $2,000,000, the estimated profits lost because of Baker’s damage infliction. a. The $2,000,000 is not taxable because it replaces the goodwill destroyed. b. The $2,000,000 is not taxable because Able did nothing to earn the money. c. The $2,000,000 is not taxable because it represents a recovery of capital. d. The $2,000,000 is not taxable because Able settled the case. e. None of the above. ____ 56. Turner, a successful executive, is negotiating a compensation plan with his potential employer. The employer has offered to pay Turner a $720,000 annual salary, payable at the rate of $60,000 per month. Turner counteroffers to receive a monthly salary of $50,000 ($600,000 annually) and a $180,000 bonus in 5 years when Turner will be age 65. a. If the employer accepts Turner’s counteroffer, Turner will recognize $65,000 ($780,000 ÷ 12) each month. b. If the employer accepts Turner’s counteroffer, Turner will be in constructive receipt of $60,000 per month. c. If the employer accepts Turner’s counteroffer, Turner will be in constructive receipt of $60,000 per month and the $180,000 bonus. d. If the employer accepts Turner’s counteroffer, Turner will recognize as gross income $50,000 per month and $180,000 in year 5. e. None of the above. ____ 57. The annual increase in the cash surrender value of a life insurance policy is not recognized as income each year because: a. Life insurance is never taxable. b. The amount of the increase is difficult to determine. c. The policyholder must cancel the policy to receive the increase. d. The amount is included in the gross income of the beneficiary when the life insurance proceeds are received upon the death of the insured. e. None of the above.

7

Name: ________________________

ID: A

____ 58. Home Office, Inc., an accrual basis taxpayer, leased a copying machine to a new customer on December 27, 2006. The machine was to rent for $500 per month for a period of 36 months beginning January 1, 2007. The customer was required to pay the first and last month’s rent at the time the lease was signed. The customer also was required to pay an $800 damage deposit. Home Office must recognize as income from the lease in 2006: a. $0. b. $500. c. $1,000. d. $1,800. e. None of the above. ____ 59. Orange Cable TV Company, an accrual basis taxpayer, allows its customers to pay by the year in advance ($350 per year), or two years in advance ($680). In September 2006, the company collected the following amounts applicable to future services: October 2006-September 2008 services (two-year contracts) October 2006-September 2007 services (one-year contracts) Total

$ 72,000 64,000 $136,000

As a result of the above, Orange Cable should report as gross income: a. $136,000 in 2006. b. $64,000 in 2006. c. $84,000 in 2007. d. $111,000 in 2007. e. None of the above. ____ 60. Theresa, a cash basis taxpayer, sold a bond in 2006 for $2,800, which included $400 of accrued interest. In 2003, she had paid $3,200 for the bond including $450 of accrued interest. As a result of the above: I. II. III. IV.

Theresa has a $350 loss on the sale of the bond. Theresa has $400 of interest income. Theresa has a $600 loss on the sale of the bond. None of the above.