Federal Income Taxation Chapter 6 Solutions (other Itemized Deductions) 5w1o1i

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 445h4w

Overview 1s532p

& View Federal Income Taxation Chapter 6 Solutions (other Itemized Deductions) as PDF for free.

More details 6h715l

- Words: 3,023

- Pages: 14

Chapter 6 Other Itemized Deductions 1.

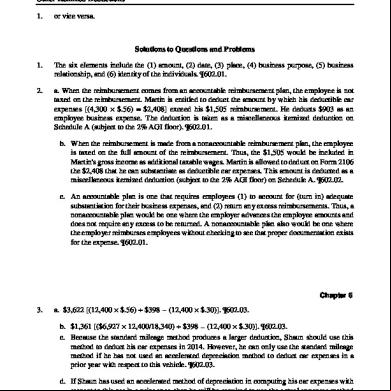

or vice versa.

Solutions to Questions and Problems 1.

The six elements include the (1) amount, (2) date, (3) place, (4) business purpose, (5) business relationship, and (6) identity of the individuals. ¶602.01.

2.

a. When the reimbursement comes from an able reimbursement plan, the employee is not taxed on the reimbursement. Martin is entitled to deduct the amount by which his deductible car expenses [(4,300 × $.56) = $2,408] exceed his $1,505 reimbursement. He deducts $903 as an employee business expense. The deduction is taken as a miscellaneous itemized deduction on Schedule A (subject to the 2% AGI floor). ¶602.01. b. When the reimbursement is made from a nonable reimbursement plan, the employee is taxed on the full amount of the reimbursement. Thus, the $1,505 would be included in Martin's gross income as additional taxable wages. Martin is allowed to deduct on Form 2106 the $2,408 that he can substantiate as deductible car expenses. This amount is deducted as a miscellaneous itemized deduction (subject to the 2% AGI floor) on Schedule A. ¶602.02. c. An able plan is one that requires employees (1) to for (turn in) adequate substantiation for their business expenses, and (2) return any excess reimbursements. Thus, a nonable plan would be one where the employer advances the employee amounts and does not require any excess to be returned. A nonable plan also would be one where the employer reimburses employees without checking to see that proper documentation exists for the expense. ¶602.01.

Chapter 6

3.

a. $3,622 [(12,400 × $.56) + $398 − (12,400 × $.30)]. ¶602.03. b. $1,361 [($6,927 × 12,400/18,340) + $398 − (12,400 × $.30)]. ¶602.03. c. Because the standard mileage method produces a larger deduction, Shaun should use this method to deduct his car expenses in 2014. However, he can only use the standard mileage method if he has not used an accelerated depreciation method to deduct car expenses in a prior year with respect to this vehicle. ¶602.03. d. If Shaun has used an accelerated method of depreciation in computing his car expenses with respect to this car in a prior year, then he will be required to use the actual expenses method to compute his car expenses for all subsequent tax years involving this vehicle. ¶602.03.

©2014 CCH Incorporated. All Rights Reserved.

2

4.

Essentials of Federal Income Taxation

a. Under the actual expenses method, Ginger's car deduction would be $268 [($8,084 × 2,235/15,544 − (2,235 × $.40)]. Under the standard mileage method, her deduction would be $358 [(2,235 × $.56) − (2,235 × $.40)]. The standard mileage method produces a greater deduction. ¶602.03. b. Since the reimbursement is made from an able plan, Ginger is not taxed on the reimbursement. If she wants to deduct the excess of her car expenses over the reimbursed amount, she will report both the business portion of her car expenses and the reimbursement on Form 2106. The excess amount would then be deducted as a miscellaneous itemized deduction on Schedule A. ¶602.03.

5.

a. Only Ricardo's mileage between job one and job two is deductible. 12 miles (distance from first to second job) × 250 days = 3,000 total deductible business miles. ¶602.03. b. $1,680 (3,000 × $.56). ¶602.03.

6.

a. $2,465. Since Josh's domestic trip was primarily for business, all of the airfare is deductible. However, only the business portion (60% of the travel time) of the other expenses is deductible. ¶602.05. Airfare $1,500 Lodging (60% × $1,250)

750

Meals (60% × $500)

$300

Entertainment

130 $430

Less: 50% × $430

(215)

Total misc. deduction (subject to the 2% AGI floor)

215 $2,465

b. $1,865. Since the personal portion of the foreign travel exceeded 25%, Josh must allocate his airfare between business and pleasure. The other expenses are calculated the same as in Part a. ¶602.05. Airfare (60% × $1,500) Lodging (60% × $1,250) Meals (60% × $500) Entertainment

$ 900 750

Less: 50% × $430 Total misc. deduction (subject to the 2% AGI floor) 7.

$300 130 $430 (215)

215 $1,865

a. $1,340. Since her trip was not primarily for business, Katie is only allowed to deduct the business portion of her lodging and meals. She cannot deduct any of the $830 ($650 + $180) spent of

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

3

traveling to and from the convention. Her business deduction is $1,340 [($200 × 6 nights) + (50% × $40 × 7)]. ¶602.05. b. $1,755. If her travels are outside of the U.S., Katie prorates all of her expenses between business and personal days. This would allow her to deduct an additional $415 ($830 × 7/14) for her airfare and transportation to and from the airport. ¶602.05. c. $2,170. If Katie were to reduce her personal days by one, her six personal days would be 50% or less of her 13 total days gone. She would then be allowed to deduct the full $830 of her costs of getting to and from her destination. ¶602.05. d. $1,787. Her deductible airfare and transportation to and from the airport would increase to $447 ($830 × 7/13). This would increase Katie's total deduction by $32 ($447 − $415). ¶602.05. 8.

Courtney can deduct $125 ($250 × 50%) for the concert tickets. It is not necessary that she attend the concert with the client to claim the deduction. Because she did not dine with the other customer, she cannot deduct any of the $210. Courtney reports the $125 on Form 2106 along with any other employee business expenses she has for the year. She then deducts the total of her unreimbursed employee business expenses as a miscellaneous deduction (subject to the 2% AGI floor) on Schedule A. ¶602.06.

9.

a. If the taxpayer is currently employed as a A, the taxpayer has met the minimum education requirements for his or her current job. Also, the ing courses will not qualify the taxpayer for a new (i.e., different) trade or business. Since the courses are required by law for the taxpayer to maintain his or her status as a A, the $525 qualifies for the education expense deduction. ¶602.07. b. Since the taxpayer is enrolled in a program of study that would lead to a new trade or business, the requirements for deducting the $3,500 as an education expense deduction have not been met. ¶602.07. c. The taxpayer has already met the minimum education requirements for being a teacher. Furthermore, the courses will not qualify the taxpayer for a new trade or business. However, the courses will improve the taxpayer's present skills at his present job, so the $2,700 qualifies for the education expense deduction. ¶602.07. d. Because the taxpayer is employed as an executive, he or she must already have met the minimum education requirements for the taxpayer's current job. Upon completion of the executive MBA program, the taxpayer will be qualified to be an executive - a position the taxpayer already holds. Thus, the courses are not part of a program of study that will qualify the taxpayer for a new trade or business. However, the courses will improve the executive's skills at his or her current job, so the $8,000 qualifies for the education expense deduction. ¶602.07.

10.

If Kris is currently employed as a manager, he can deduct the $1,700 as a miscellaneous itemized deduction (subject to the 2% AGI floor), regardless of whether his efforts result in a new position. If Kris is not currently employed as a manager, his job hunting costs are not deductible.

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

4

Essentials of Federal Income Taxation

Therefore, in Parts a. and b. the deduction will be allowed; it Parts c. and d. it will not. ¶602.07. 11. Item

Answer

a. b. c. d. e. f. g. h.

State inheritance taxes (¶504.04) Transportation to and from home and work (¶602.03) Rental of safe-deposit box (¶603) Fee to for the A examination (¶602.07) IRS late-filing penalty (¶504.04) Fee to ant for property tax return on rental property (¶105.01) Loss in operating bookstore (¶105.01) Auto registration for business automobile (¶105.01)

C C B C C A A A

a. b. c. d. e. f. g. h.

Item Cost of uniforms suitable for street wear (¶602.07) Insurance on personal residence (¶604.03) Union dues paid by employee (¶602.07) Travel expense by employee, no reimbursement (¶602.05) Mortgage interest on rental property (¶105.01) Loss of trees due to storm (¶507) Loss on sale of personal car (¶203.03) Amounts paid to fix friend's car (taxpayer's fault) (¶507) After adjusting for $100 deductible and 10% of adjusted gross income.

Answer C C B B A B1 C C

Item

Answer

12.

1

13.

b. c. d. e. f. g. 14.

of stock (¶203.03) A Interest on loan for vacation (¶505) C Travel expense for a statutory employee (¶601) Depreciation on rental property (¶105.01) A Charitable contribution to university (¶506) Cost of seminar for sole proprietor (¶105.01) Storm damage to rental property (¶105.01)

a. Loss on sale

A B A A

a. A hobby is an activity from which a taxpayer does not expect to make a profit. The question of whether a profit motive exists arises in cases where an activity has elements of both personal pleasure and profit. Some of the factors considered in determining whether an activity is a business or a hobby include: (1) (2) (3) (4) (5)

Chapter 6

The taxpayer's past success with other activities. Whether separate books and records were kept for the activity. Whether there have been both profits and losses in prior years. The relative amount of pleasure derived from the activity. The extent of dependency on the activity for financial . ©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

(6) (7) (8) (9)

5

The amount of time and effort devoted to the activity. The taxpayer's expertise in the area. The amount of the occasional profits from the activity. The expectation that the property used in the activity will rise in value.

The taxpayer must show that the activity is being pursued for profit but does not need to justify that the expectation of profit is necessarily reasonable. The taxpayer does not need to show a profit each year. If the activity shows a profit in any three of five consecutive years (two years out of seven for activities involving horses), the burden of proof shifts to the IRS. The IRS then must prove the activity is a hobby. ¶603.01. b. No. However, if the activity shows a profit in any three of five consecutive years, the burden of proof shifts to the IRS to prove that the activity is a hobby. The taxpayer may also exercise an election to postpone any IRS challenge until five years of business activity have been completed. ¶603.01. 15.

a. Expenses of painting activity treated as a business: Allocated expenses of the home: Property taxes $3,600 Electricity 2,400 Heat 2,900 Total general household expenses $8,900 Business use percentage × 12% Portion of general expenses related to the painting activity $1,068 Expenses related directly to the painting activity: Interest on loan 140 Painting supplies 1,750 Total expenses for the painting activity $2,958 If Russ's painting activity is treated as a business, he reports an above the line deduction for the loss of $658, computed as follows: Revenues $ (2,958) Net loss

2,300

Less:

Total

expenses

(from

above)

$ ( 658)

Russ could deduct the loss on the assumption that the painting activity is a business, and expects to report a profit in three of the first five years of the business. ¶603.01. b. If Russ cannot justify the activity as a business, then he is required to report the $2,300 of revenue from the sale of the paintings as income. When an activity is considered a hobby, the taxpayer is allowed to deduct expenses up to the amount of the revenue (as a miscellaneous itemized deduction subject to the 2% AGI floor), but any excess expenses would not be deductible. Thus, if the painting activity is treated as a hobby, Russ would report revenues and expenses as follows. ¶603.01. Revenues Less: Total expenses ($2,958, but limited to hobby income)

$2,300 (2,300) The

allowable expenses ($2,300) are deductible as follows: ©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

6

Essentials of Federal Income Taxation

(1) (2)

$432 (12% × $3,600) is deductible as property tax (line 6). $1,868 (remainder) is deductible only to the extent that miscellaneous itemized deductions exceed 2% of AGI.

c. Russ might his claim that the painting activity is a business by arranging for regular displays of his paintings in galleries and by making every effort to earn a profit in three of five consecutive years. If he has discretionary expenses related to the activity, such as subscriptions to art magazines, he might be able to postpone payments until early in the next year in order to show a profit in a given year to help meet the three-out-of-five-year profit rule. The timing of the payment of property taxes and electricity bills might also the opportunity to show a profit in certain years. ¶603.01. 16.

a. $354. Roger can include as itemized deductions $149 for transportation expenses (266 × $.56) plus $205 [(50% × $120) + $110 + $35] for meeting expenses, union dues, and her license. ¶603.01. b.

These expenses would be combined with other 2% miscellaneous itemized expenses such as safe deposit box rents, investment expenses (other than investment interest expense), and tax return preparation fees. The total of such costs can be deducted to the extent that it exceeds 2% of adjusted gross income. ¶603.01.

17.

a. Mark reports the $1,400 of winnings and $1,400 of the losses on his income tax return. All gambling winnings are included in gross income, but gambling losses are deductible only to the extent of gambling income. Gambling losses are miscellaneous itemized deductions, but are not subject to the 2% AGI floor. ¶604.01. b.

The $1,400 of the winnings is entered as "Other income" on Form 1040. Only $1,400 of the losses can be entered on Schedule A as a miscellaneous deduction not subject to the 2% AGI floor. Deductions from AGI must be itemized in order for any gambling losses to be deductible. ¶604.01.

18.

See filled-in Form 2106 for Nancy Lopez. Since the $9,000 reimbursement was made from a nonable reimbursement plan, and therefore properly reported on Nancy's W-2, no amount is shown on Form 2106 (line 7). ¶602.08.

19.

Taxpayers may deduct only the price of nonluxury box seats when they entertain clients in a luxury skybox rented for more than one event. Thus, Alpha-Beta may consider only $4,800 as its entertainment cost for the rental of the skybox. This amount represents the cost of 96 seats (12 seats for 8 games) at $50 per seat. It should also be pointed out that only 50% of the $4,800 is actually deductible ($2,400). See also page 13 of Publication 463.

20.

a.

False. Statutory employees report travel expenses on Schedule C. ¶601.

b.

True. ¶602.01.

c.

False. Only one-half is deductible. ¶602.06.

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

d. 21.

7

True. ¶602.07.

¶603, ¶604. 1.

Unreimbursed employee expenses, $1,044 [$376 + $115 + ($256 × 50%) + $340 + $85]

22.

2.

Tax preparation fees, $175

3.

Other expenses subject to the 2% AGI floor, $165 ($45 + $120)

4.

Total expenses, $1,384

5.

Less: 2% of AGI, $948 ($47,400 × .02)

6.

Deductible expenses, $436

7.

Other miscellaneous expenses, $65 (limited to gambling winnings)

See filled-in Schedule A for the Churches. Without proper substantiation for their $310 contribution to the United Way, no deduction can be taken. ¶605.

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

8

Essentials of Federal Income Taxation

Form 2106, page 1 for Nancy Lopez

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

9

Form Form2106, 2106,page page22for forNancy NancyLopez Lopez

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

10

Essentials of Federal Income Taxation

IRS Publication 463, page 13

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

11

Schedule A for the Churches

23.

a. See filled-in Schedule A for the Gomezes. The Gomezes have ample net investment income to deduct the $2,000 of investment interest expense. ¶605.

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

12

Essentials of Federal Income Taxation

b. Adjusted gross income $376,181 Less: Itemized deductions* ( 52,152) $324,029 Less: Exemption deduction** ( 4,977) Taxable income $319,052 * Total itemized deductions are reduced by $2,134 (($376,181 − $305,050 threshold for MFJ) × 3%) ** Full exemption ($3,950 × 3) AGI AGI threshold for MFJ Excess AGI Divide by $2,500 for MFJ Rounded to nearest whole number

Exemption deduction

Chapter 6

$11,850 $376,181 (305,050) $ 71,131 ÷ 2,500 28.45 29 × .02 .58 × $11,850

(6,873) $ 4,977

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

13

Schedule A for the Gomezes

Cumulative Problem: Chapters 1-6 ©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

14

Essentials of Federal Income Taxation

Inga does not qualify as a dependent because she did not live with the Andersons for the entire year. Frank is not taxed on the employer-paid s on group-term life insurance since the policy was for less than $50,000 ($54,500 × 75% = $40,875). Form 2106 (line 22): 13,877 × $.56 = $7,771 IRA deduction (Form 1040, line 32), $10,720 ($6,500 + $4,220). Since Sandra is not a participant in an employer-sponsored retirement plan and the Andersons' modified AGI does not exceed $181,000, she is allowed to contribute and deduct up to $6,500 ($5,500 + $1,000 for being age 50 or older). However, Frank is a participant in his employer's retirement plan and the Andersons' modified AGI falls between the $96,000 and $116,000 threshold for married couples filing a t return. Thus, Frank's maximum deductible IRA contribution is computed as follows: Reduction factor for Frank: [($100,685 − $96,000)/$20,000 phase-out range] × $5,500 = $1,288 Contribution limit: $5,500 − $1,288 = $4,212, rounded up to nearest $10: $4,220

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

or vice versa.

Solutions to Questions and Problems 1.

The six elements include the (1) amount, (2) date, (3) place, (4) business purpose, (5) business relationship, and (6) identity of the individuals. ¶602.01.

2.

a. When the reimbursement comes from an able reimbursement plan, the employee is not taxed on the reimbursement. Martin is entitled to deduct the amount by which his deductible car expenses [(4,300 × $.56) = $2,408] exceed his $1,505 reimbursement. He deducts $903 as an employee business expense. The deduction is taken as a miscellaneous itemized deduction on Schedule A (subject to the 2% AGI floor). ¶602.01. b. When the reimbursement is made from a nonable reimbursement plan, the employee is taxed on the full amount of the reimbursement. Thus, the $1,505 would be included in Martin's gross income as additional taxable wages. Martin is allowed to deduct on Form 2106 the $2,408 that he can substantiate as deductible car expenses. This amount is deducted as a miscellaneous itemized deduction (subject to the 2% AGI floor) on Schedule A. ¶602.02. c. An able plan is one that requires employees (1) to for (turn in) adequate substantiation for their business expenses, and (2) return any excess reimbursements. Thus, a nonable plan would be one where the employer advances the employee amounts and does not require any excess to be returned. A nonable plan also would be one where the employer reimburses employees without checking to see that proper documentation exists for the expense. ¶602.01.

Chapter 6

3.

a. $3,622 [(12,400 × $.56) + $398 − (12,400 × $.30)]. ¶602.03. b. $1,361 [($6,927 × 12,400/18,340) + $398 − (12,400 × $.30)]. ¶602.03. c. Because the standard mileage method produces a larger deduction, Shaun should use this method to deduct his car expenses in 2014. However, he can only use the standard mileage method if he has not used an accelerated depreciation method to deduct car expenses in a prior year with respect to this vehicle. ¶602.03. d. If Shaun has used an accelerated method of depreciation in computing his car expenses with respect to this car in a prior year, then he will be required to use the actual expenses method to compute his car expenses for all subsequent tax years involving this vehicle. ¶602.03.

©2014 CCH Incorporated. All Rights Reserved.

2

4.

Essentials of Federal Income Taxation

a. Under the actual expenses method, Ginger's car deduction would be $268 [($8,084 × 2,235/15,544 − (2,235 × $.40)]. Under the standard mileage method, her deduction would be $358 [(2,235 × $.56) − (2,235 × $.40)]. The standard mileage method produces a greater deduction. ¶602.03. b. Since the reimbursement is made from an able plan, Ginger is not taxed on the reimbursement. If she wants to deduct the excess of her car expenses over the reimbursed amount, she will report both the business portion of her car expenses and the reimbursement on Form 2106. The excess amount would then be deducted as a miscellaneous itemized deduction on Schedule A. ¶602.03.

5.

a. Only Ricardo's mileage between job one and job two is deductible. 12 miles (distance from first to second job) × 250 days = 3,000 total deductible business miles. ¶602.03. b. $1,680 (3,000 × $.56). ¶602.03.

6.

a. $2,465. Since Josh's domestic trip was primarily for business, all of the airfare is deductible. However, only the business portion (60% of the travel time) of the other expenses is deductible. ¶602.05. Airfare $1,500 Lodging (60% × $1,250)

750

Meals (60% × $500)

$300

Entertainment

130 $430

Less: 50% × $430

(215)

Total misc. deduction (subject to the 2% AGI floor)

215 $2,465

b. $1,865. Since the personal portion of the foreign travel exceeded 25%, Josh must allocate his airfare between business and pleasure. The other expenses are calculated the same as in Part a. ¶602.05. Airfare (60% × $1,500) Lodging (60% × $1,250) Meals (60% × $500) Entertainment

$ 900 750

Less: 50% × $430 Total misc. deduction (subject to the 2% AGI floor) 7.

$300 130 $430 (215)

215 $1,865

a. $1,340. Since her trip was not primarily for business, Katie is only allowed to deduct the business portion of her lodging and meals. She cannot deduct any of the $830 ($650 + $180) spent of

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

3

traveling to and from the convention. Her business deduction is $1,340 [($200 × 6 nights) + (50% × $40 × 7)]. ¶602.05. b. $1,755. If her travels are outside of the U.S., Katie prorates all of her expenses between business and personal days. This would allow her to deduct an additional $415 ($830 × 7/14) for her airfare and transportation to and from the airport. ¶602.05. c. $2,170. If Katie were to reduce her personal days by one, her six personal days would be 50% or less of her 13 total days gone. She would then be allowed to deduct the full $830 of her costs of getting to and from her destination. ¶602.05. d. $1,787. Her deductible airfare and transportation to and from the airport would increase to $447 ($830 × 7/13). This would increase Katie's total deduction by $32 ($447 − $415). ¶602.05. 8.

Courtney can deduct $125 ($250 × 50%) for the concert tickets. It is not necessary that she attend the concert with the client to claim the deduction. Because she did not dine with the other customer, she cannot deduct any of the $210. Courtney reports the $125 on Form 2106 along with any other employee business expenses she has for the year. She then deducts the total of her unreimbursed employee business expenses as a miscellaneous deduction (subject to the 2% AGI floor) on Schedule A. ¶602.06.

9.

a. If the taxpayer is currently employed as a A, the taxpayer has met the minimum education requirements for his or her current job. Also, the ing courses will not qualify the taxpayer for a new (i.e., different) trade or business. Since the courses are required by law for the taxpayer to maintain his or her status as a A, the $525 qualifies for the education expense deduction. ¶602.07. b. Since the taxpayer is enrolled in a program of study that would lead to a new trade or business, the requirements for deducting the $3,500 as an education expense deduction have not been met. ¶602.07. c. The taxpayer has already met the minimum education requirements for being a teacher. Furthermore, the courses will not qualify the taxpayer for a new trade or business. However, the courses will improve the taxpayer's present skills at his present job, so the $2,700 qualifies for the education expense deduction. ¶602.07. d. Because the taxpayer is employed as an executive, he or she must already have met the minimum education requirements for the taxpayer's current job. Upon completion of the executive MBA program, the taxpayer will be qualified to be an executive - a position the taxpayer already holds. Thus, the courses are not part of a program of study that will qualify the taxpayer for a new trade or business. However, the courses will improve the executive's skills at his or her current job, so the $8,000 qualifies for the education expense deduction. ¶602.07.

10.

If Kris is currently employed as a manager, he can deduct the $1,700 as a miscellaneous itemized deduction (subject to the 2% AGI floor), regardless of whether his efforts result in a new position. If Kris is not currently employed as a manager, his job hunting costs are not deductible.

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

4

Essentials of Federal Income Taxation

Therefore, in Parts a. and b. the deduction will be allowed; it Parts c. and d. it will not. ¶602.07. 11. Item

Answer

a. b. c. d. e. f. g. h.

State inheritance taxes (¶504.04) Transportation to and from home and work (¶602.03) Rental of safe-deposit box (¶603) Fee to for the A examination (¶602.07) IRS late-filing penalty (¶504.04) Fee to ant for property tax return on rental property (¶105.01) Loss in operating bookstore (¶105.01) Auto registration for business automobile (¶105.01)

C C B C C A A A

a. b. c. d. e. f. g. h.

Item Cost of uniforms suitable for street wear (¶602.07) Insurance on personal residence (¶604.03) Union dues paid by employee (¶602.07) Travel expense by employee, no reimbursement (¶602.05) Mortgage interest on rental property (¶105.01) Loss of trees due to storm (¶507) Loss on sale of personal car (¶203.03) Amounts paid to fix friend's car (taxpayer's fault) (¶507) After adjusting for $100 deductible and 10% of adjusted gross income.

Answer C C B B A B1 C C

Item

Answer

12.

1

13.

b. c. d. e. f. g. 14.

of stock (¶203.03) A Interest on loan for vacation (¶505) C Travel expense for a statutory employee (¶601) Depreciation on rental property (¶105.01) A Charitable contribution to university (¶506) Cost of seminar for sole proprietor (¶105.01) Storm damage to rental property (¶105.01)

a. Loss on sale

A B A A

a. A hobby is an activity from which a taxpayer does not expect to make a profit. The question of whether a profit motive exists arises in cases where an activity has elements of both personal pleasure and profit. Some of the factors considered in determining whether an activity is a business or a hobby include: (1) (2) (3) (4) (5)

Chapter 6

The taxpayer's past success with other activities. Whether separate books and records were kept for the activity. Whether there have been both profits and losses in prior years. The relative amount of pleasure derived from the activity. The extent of dependency on the activity for financial . ©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

(6) (7) (8) (9)

5

The amount of time and effort devoted to the activity. The taxpayer's expertise in the area. The amount of the occasional profits from the activity. The expectation that the property used in the activity will rise in value.

The taxpayer must show that the activity is being pursued for profit but does not need to justify that the expectation of profit is necessarily reasonable. The taxpayer does not need to show a profit each year. If the activity shows a profit in any three of five consecutive years (two years out of seven for activities involving horses), the burden of proof shifts to the IRS. The IRS then must prove the activity is a hobby. ¶603.01. b. No. However, if the activity shows a profit in any three of five consecutive years, the burden of proof shifts to the IRS to prove that the activity is a hobby. The taxpayer may also exercise an election to postpone any IRS challenge until five years of business activity have been completed. ¶603.01. 15.

a. Expenses of painting activity treated as a business: Allocated expenses of the home: Property taxes $3,600 Electricity 2,400 Heat 2,900 Total general household expenses $8,900 Business use percentage × 12% Portion of general expenses related to the painting activity $1,068 Expenses related directly to the painting activity: Interest on loan 140 Painting supplies 1,750 Total expenses for the painting activity $2,958 If Russ's painting activity is treated as a business, he reports an above the line deduction for the loss of $658, computed as follows: Revenues $ (2,958) Net loss

2,300

Less:

Total

expenses

(from

above)

$ ( 658)

Russ could deduct the loss on the assumption that the painting activity is a business, and expects to report a profit in three of the first five years of the business. ¶603.01. b. If Russ cannot justify the activity as a business, then he is required to report the $2,300 of revenue from the sale of the paintings as income. When an activity is considered a hobby, the taxpayer is allowed to deduct expenses up to the amount of the revenue (as a miscellaneous itemized deduction subject to the 2% AGI floor), but any excess expenses would not be deductible. Thus, if the painting activity is treated as a hobby, Russ would report revenues and expenses as follows. ¶603.01. Revenues Less: Total expenses ($2,958, but limited to hobby income)

$2,300 (2,300) The

allowable expenses ($2,300) are deductible as follows: ©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

6

Essentials of Federal Income Taxation

(1) (2)

$432 (12% × $3,600) is deductible as property tax (line 6). $1,868 (remainder) is deductible only to the extent that miscellaneous itemized deductions exceed 2% of AGI.

c. Russ might his claim that the painting activity is a business by arranging for regular displays of his paintings in galleries and by making every effort to earn a profit in three of five consecutive years. If he has discretionary expenses related to the activity, such as subscriptions to art magazines, he might be able to postpone payments until early in the next year in order to show a profit in a given year to help meet the three-out-of-five-year profit rule. The timing of the payment of property taxes and electricity bills might also the opportunity to show a profit in certain years. ¶603.01. 16.

a. $354. Roger can include as itemized deductions $149 for transportation expenses (266 × $.56) plus $205 [(50% × $120) + $110 + $35] for meeting expenses, union dues, and her license. ¶603.01. b.

These expenses would be combined with other 2% miscellaneous itemized expenses such as safe deposit box rents, investment expenses (other than investment interest expense), and tax return preparation fees. The total of such costs can be deducted to the extent that it exceeds 2% of adjusted gross income. ¶603.01.

17.

a. Mark reports the $1,400 of winnings and $1,400 of the losses on his income tax return. All gambling winnings are included in gross income, but gambling losses are deductible only to the extent of gambling income. Gambling losses are miscellaneous itemized deductions, but are not subject to the 2% AGI floor. ¶604.01. b.

The $1,400 of the winnings is entered as "Other income" on Form 1040. Only $1,400 of the losses can be entered on Schedule A as a miscellaneous deduction not subject to the 2% AGI floor. Deductions from AGI must be itemized in order for any gambling losses to be deductible. ¶604.01.

18.

See filled-in Form 2106 for Nancy Lopez. Since the $9,000 reimbursement was made from a nonable reimbursement plan, and therefore properly reported on Nancy's W-2, no amount is shown on Form 2106 (line 7). ¶602.08.

19.

Taxpayers may deduct only the price of nonluxury box seats when they entertain clients in a luxury skybox rented for more than one event. Thus, Alpha-Beta may consider only $4,800 as its entertainment cost for the rental of the skybox. This amount represents the cost of 96 seats (12 seats for 8 games) at $50 per seat. It should also be pointed out that only 50% of the $4,800 is actually deductible ($2,400). See also page 13 of Publication 463.

20.

a.

False. Statutory employees report travel expenses on Schedule C. ¶601.

b.

True. ¶602.01.

c.

False. Only one-half is deductible. ¶602.06.

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

d. 21.

7

True. ¶602.07.

¶603, ¶604. 1.

Unreimbursed employee expenses, $1,044 [$376 + $115 + ($256 × 50%) + $340 + $85]

22.

2.

Tax preparation fees, $175

3.

Other expenses subject to the 2% AGI floor, $165 ($45 + $120)

4.

Total expenses, $1,384

5.

Less: 2% of AGI, $948 ($47,400 × .02)

6.

Deductible expenses, $436

7.

Other miscellaneous expenses, $65 (limited to gambling winnings)

See filled-in Schedule A for the Churches. Without proper substantiation for their $310 contribution to the United Way, no deduction can be taken. ¶605.

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

8

Essentials of Federal Income Taxation

Form 2106, page 1 for Nancy Lopez

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

9

Form Form2106, 2106,page page22for forNancy NancyLopez Lopez

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

10

Essentials of Federal Income Taxation

IRS Publication 463, page 13

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

11

Schedule A for the Churches

23.

a. See filled-in Schedule A for the Gomezes. The Gomezes have ample net investment income to deduct the $2,000 of investment interest expense. ¶605.

©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

12

Essentials of Federal Income Taxation

b. Adjusted gross income $376,181 Less: Itemized deductions* ( 52,152) $324,029 Less: Exemption deduction** ( 4,977) Taxable income $319,052 * Total itemized deductions are reduced by $2,134 (($376,181 − $305,050 threshold for MFJ) × 3%) ** Full exemption ($3,950 × 3) AGI AGI threshold for MFJ Excess AGI Divide by $2,500 for MFJ Rounded to nearest whole number

Exemption deduction

Chapter 6

$11,850 $376,181 (305,050) $ 71,131 ÷ 2,500 28.45 29 × .02 .58 × $11,850

(6,873) $ 4,977

©2014 CCH Incorporated. All Rights Reserved.

Textbook Solutions

13

Schedule A for the Gomezes

Cumulative Problem: Chapters 1-6 ©2014 CCH Incorporated. All Rights Reserved.

Chapter 6

14

Essentials of Federal Income Taxation

Inga does not qualify as a dependent because she did not live with the Andersons for the entire year. Frank is not taxed on the employer-paid s on group-term life insurance since the policy was for less than $50,000 ($54,500 × 75% = $40,875). Form 2106 (line 22): 13,877 × $.56 = $7,771 IRA deduction (Form 1040, line 32), $10,720 ($6,500 + $4,220). Since Sandra is not a participant in an employer-sponsored retirement plan and the Andersons' modified AGI does not exceed $181,000, she is allowed to contribute and deduct up to $6,500 ($5,500 + $1,000 for being age 50 or older). However, Frank is a participant in his employer's retirement plan and the Andersons' modified AGI falls between the $96,000 and $116,000 threshold for married couples filing a t return. Thus, Frank's maximum deductible IRA contribution is computed as follows: Reduction factor for Frank: [($100,685 − $96,000)/$20,000 phase-out range] × $5,500 = $1,288 Contribution limit: $5,500 − $1,288 = $4,212, rounded up to nearest $10: $4,220

Chapter 6

©2014 CCH Incorporated. All Rights Reserved.